BitQuick.co, A Platform to Buy Bitcoins With Cash Instantly, Had To Restrict Access To New York Residents

This was a direct result of the extensive regulations introduced by the recent implementation of the BitLicense, as reported by CNN on July 18, 2015. The BitLicense imposes a $5,000 fee to all applicants, alongside various regulatory requirements that would need to be continually met.

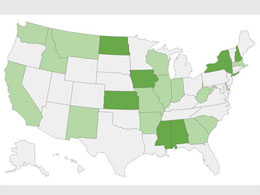

BitQuick joins a continuing trend of Bitcoin companies to pull their services from New York. To better inform consumers of the situation at hand, New York customers are being redirected to PleaseProtectConsumers.org. ShapeShift.io was one of the first to take such action in June 15, 2015, followed shortly by GoCoin, according to their press release. On Saturday, the largest Bitcoin exchange for USD, BitFinex, also announced that they would be restricting access to their platform for New York customers.

“$5,000 for a new startup is a deep expense. When you’re talking about many companies who are in pre-seed stages, they don’t even stand a chance to try,” said BitQuick.co Founder Jad Mubaslat,

“New York isn’t a problem now; we’ll have to wait for them to come around. But if other states followed suit, there would be a serious chokehold on innovation. Innovators would flee to unrestricted states or territories. Not to mention the state by state regulatory framework in place right now is a mess to begin with.”

BitQuick stated that the regulation is overbearing relative to the size of the Bitcoin industry, and indiscriminate towards small and large startups. They state that this can also put consumers at risk by requiring various companies to maintain in depth records of their customers. Sensitive financial databases are routinely cracked. Just recently online cheating website, AshleyMadison.com was hacked putting 37 million users’ personal information at risk, according to CNN.com on July 20, 2015.

However, there are still some exchanges that will remain and comply with New York regulation. Unreleased Gemini exchange, created by the Winklevoss twins, and itBit will be complying via being granted New York State Trust Charters, according to Reuters on July 24, 2015.

About BitQuick.co

BitQuick allows anyone to buy bitcoins instantly with cash in the United States. BitQuick is the second largest P2P Bitcoin exchange by volume in the world.

BitQuick.co

https://www.bitquick.co/

Related News