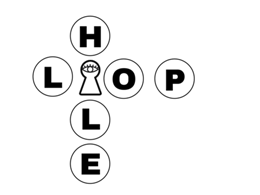

How Bitcoin Investors Can Enjoy This Tax Loophole Benefit, For Now

The U.S. “wash sale rule” gives bitcoin investors the chance to realize tax breaks. Here’s how.Bitcoin has digitized the transfer of value at the speed of the internet. Yet such technological leaps tend to temporarily overload a bureaucracy’s ability to keep up with regulations, laws and taxation. Currently, the IRS designates bitcoin as “property” rather than currency, and characterizes the sale of bitcoin in terms of capital gains and losses, rather than ordinary income. As such, the “Wash Sale Rule” does not appear to apply to sales of bitcoin. Lacking guidance from the U.S. Department....

Related News

‘Highest in, first out’ aka HIFO is a tax accounting method that can be a very good thing to know as an investor dabbling In crypto this past year. As we approach tax season and related questions continue to rise to the top, let’s take a look at a tax methodology that we are seeing […]

Ryan Castellucci, a security researcher at digital fraud firm White Ops, shared that there could be a loophole in which bitcoin passwords can be traced to steal funds. This might be possible through brainwallets, wherein bitcoin passwords are stored in the memory of the user through a long word or phrase that interacts with the blockchain. In particular, the brainwallet password might be traced to the private key, then to the public key, and eventually to the bitcoin wallet address. Castellucci revealed his findings in the DEF CON 23 annual global hacker convention. Traceable Bitcoin....

A loophole in MakerDAO’s collateralized debt market enables positions to be closed far more leniently than intended due to an oversight in the auction process.

Alpha Finance says the "loophole" has been patched.

A weakened US Dollar is also positive for the bitcoin ecosystem, in a way. Looking ahead in the financial world is becoming quite challenging these days. Stock investors are currently concerned over the US Dollar, albeit that situation may come to change soon. After a horrible start in 20017 for the greenback, the question remains what will happen next. Further declines in value are not out of the question, which spells good news for investors. Additionally, a weaker US Dollar can benefit the bitcoin ecosystem as well. It has to be said, the bullish US Dollar trend could only be sustained....