FTX Exchange Set To Be Acquired By Binance Following Liquidity Crisis

Following a liquidity crunch, FTX reached out to Binance to solve its liquidity issues through acquisition to keep FTX customers whole.FTX Exchange is set to be acquired by Binance, pending due diligence, following a liquidity crisis from FTX, per an announcement from the CEO of FTX.“Our teams are working on clearing out the withdrawal backlog as is,” CEO Sam Bankman-Fried said regarding the pause of withdrawals on FTX assets. “This will clear out liquidity crunches; all assets will be covered 1:1. This is one of the main reasons we’ve asked Binance to come....

Related News

A major Indian cryptocurrency exchange, Wazirx, has had its bank assets of more than $8 million frozen by the Directorate of Enforcement (ED). The exchange was supposedly acquired by Binance in 2019. However, Binance CEO Changpeng Zhao (CZ) now claims that the acquisition was “never completed.” Wazirx, however, maintains that it was acquired by Binance.

ED’s Action Against Wazirx

India’s Directorate of Enforcement (ED) issued a press release Friday concerning Wazirx, a major crypto exchange in India. ED is a law enforcement and economic intelligence....

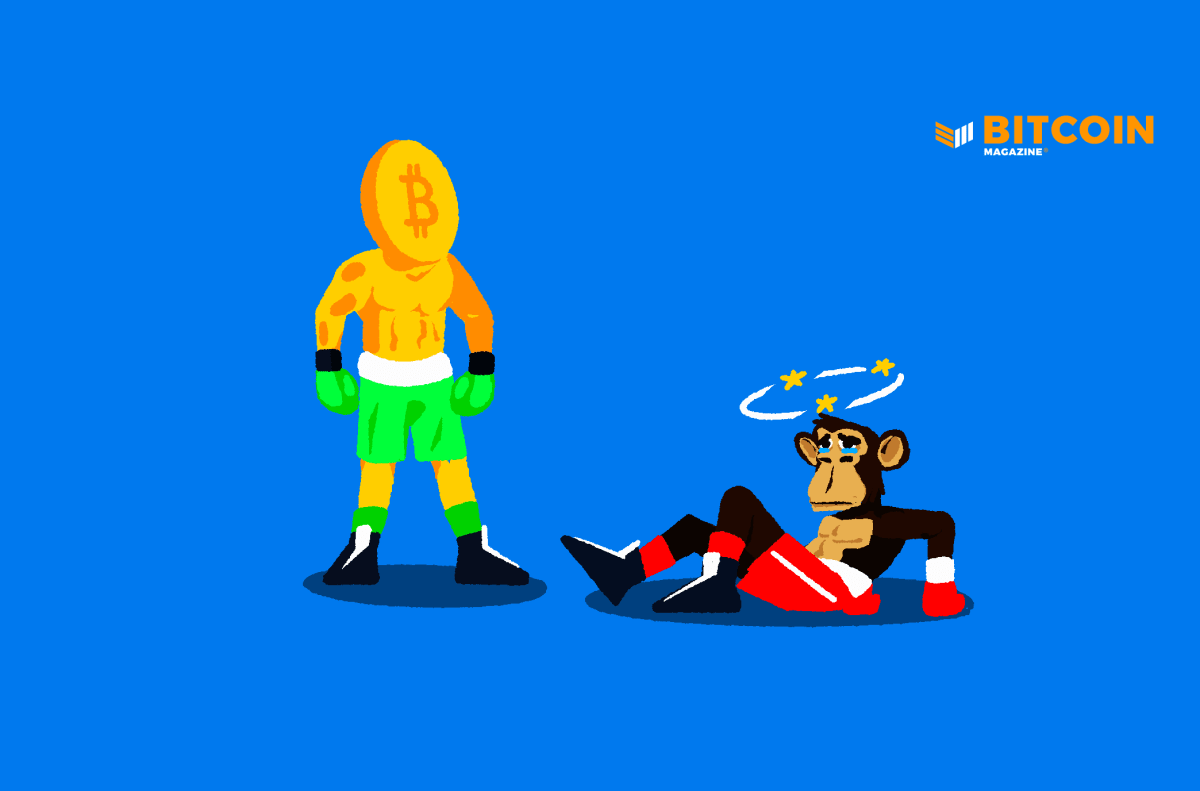

The exchange war has begun. The Binance CEO publicly dukes it out with the FTX co-founder as rumors of FTX and Alameda Research financial distress fly.

Binance CEO Changpeng Zhao clarified that the project is for other potentially strong projects and not FTX, saying that “liars or fraud” would never qualify. As the effects of the FTX crisis continue to affect the markets negatively, crypto exchange Binance is creating a fund to help potentially strong projects that are having liquidity issues. In a tweet, Binance CEO Changpeng Zhao said that the fund aims to reduce the cascading negative effects of the collapse of FTX by helping projects that the Binance CEO described as “strong, but in a liquidity crisis.” While Zhao did not provide all....

The collapse of FTX came as a surprise to many, but as more information pours in, it seems FTX's liquidity crisis began sooner than many thought. The world’s third-largest cryptocurrency exchange, FTX, started the year with a $400 million Series C funding round, taking its valuation to over $32 billion. Ten months later, the crypto exchange is staring down the possibility of bankruptcy after its bid to be acquired by Binance failed.FTX was seen as one of the largest global crypto players as it established itself with multiple mainstream brand and sponsorship partnerships and billions in....

Following the UST depeg, the crypto market started to crumble: crypto institutions crashed, exchanges suspended withdrawals, and lending protocols suffered from liquidation and runs, presenting a huge liquidity crisis. The domino effect has also fully revealed a DeFi crisis. In 2020, everyone had been excited for the DeFi Summer, and the huge popularity of liquidity […]