Synapse Liquidity Provider Abruptly Dumps 9 Million SYN Tokens, Price Plunges...

Cross-chain bridge Synapse has seen the value of its native token SYN plummet after a liquidity provider (LP) dumped all their tokens. According to data from CoinGecko, the token’s price declined by nearly 25% a few hours after the sell-off. On Tuesday, 5th of August, Synapse Labs announced – via a post on X (formerly Twitter) – that one of the liquidity providers sold their SYN tokens and removed liquidity from the Synapse protocol. Lookonchain reported a whale dumping 9 million SYN tokens an hour after this disclosure. According to the on-chain analytics platform, the whale....

Related News

Network validators were able to identify unusual activity in the platform’s AMM metapools and prevent the fraudulent transaction. Cross-chain protocols are continuing to face challenges, with Synapse Bridge narrowly averting a multi-million exploit.On Nov. 7, Synapse Bridge announced on Discord they had prevented a hacker from draining approximately $8 million USD from the Avalanche Neutral Dollar (nUSD) Metapool. The hacker attempted to exploit a vulnerability using the bridge to transfer assets from Polygon (MATIC) to Avalanche (AVAX). Synapse is a cross-chain bridge designed to....

Directional liquidity pooling is a new way for liquidity providers to add liquidity to exchanges while avoiding impermanent loss. Modern decentralized exchanges (DEXs) mainly rely on liquidity providers (LP) to provide the tokens that are being traded. These liquidity providers are rewarded by receiving a portion of the trading fees generated on the DEX. Unfortunately, while liquidity providers earn an income via fees, they’re exposed to impermanent loss if the price of their deposited assets changes.Directional liquidity pooling is a new method that is different from the traditional....

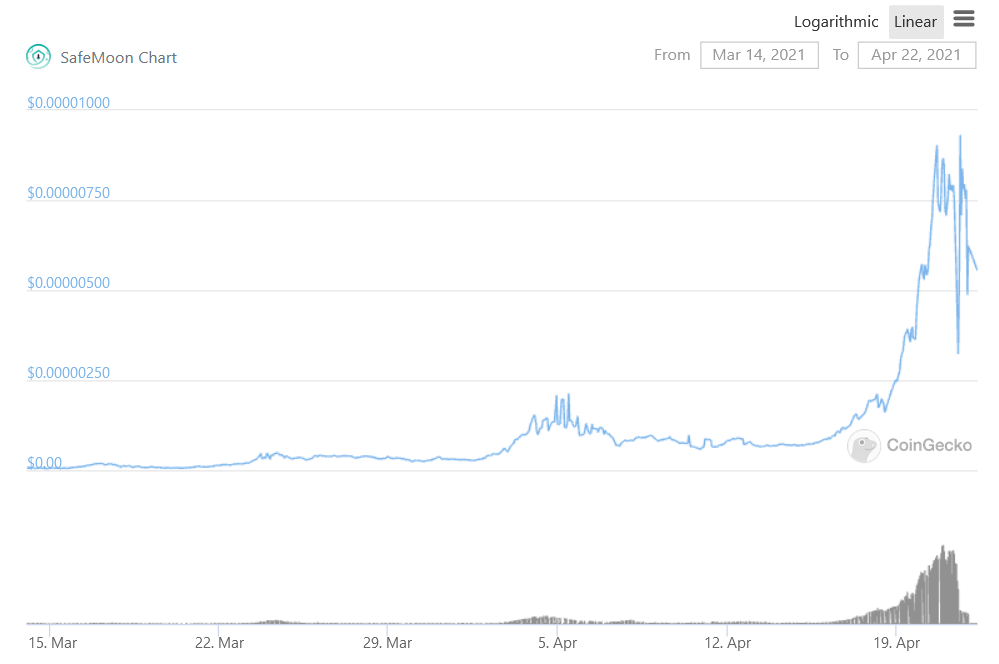

DeFi liquidity project MoonSafe is caught in a sea of controversy at present. Not only do prominent crypto personalities allege the project is a scam, but an analysis of its code by Obelisk reveals misleading claims about how liquidity provider (LP) tokens are secured. LP tokens are minted and sent to the liquidity provider’s address […]

The inventor of Ethereum Vitalik Buterin was the unintended recipient of 1 million OP tokens from this network’s scalability solution Optimism. The team behind this project addressed concerns about a potential exploit related to the launch of their governance token. Related Reading | TA: Bitcoin Stuck In Key Range, Why A Major Breakout Is Possible As clarified by Optimism, they entered a deal with liquidity provider Wintermute to “facilitate a smoother experience for users” looking to buy OP and participate in the project’s governance model. As part of the agreement, Optimism sent 20....

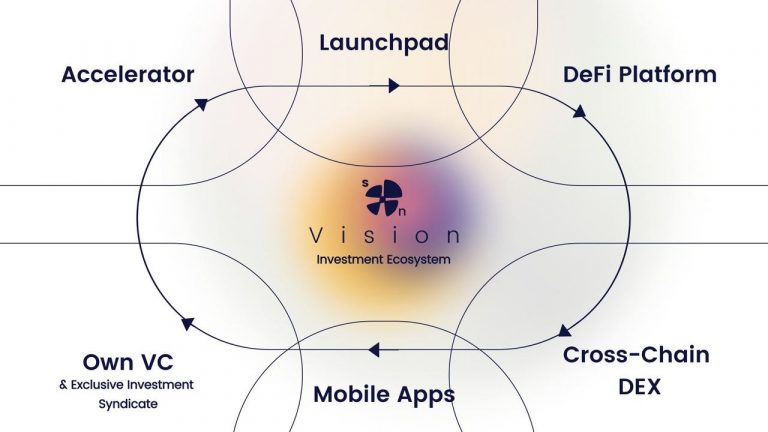

Synapse Network is developing the first cross-chain investment ecosystem based on blockchain technology. It will offer five cross-chain products for the cryptocurrency sector, including a DEX and DeFi marketplace, saving a lot of time and effort to everyone frustrated with the current fractured landscape. Trade ETH to MATIC or BNB in Just One Swap Technology specialist Synapse Network will provide investors with a simple one-stop-shop solution to consolidate their transactions. Compared to a multichain solution, where you need to invest into one of multiple pools – a costly and....