JPMorgan will reportedly give retail wealth clients access to crypto funds

Advisers at the banking giant are reportedly only allowed to execute crypto trades at the direct request of a client rather than recommending the products themselves. Major U.S. investment bank JPMorgan Chase is reportedly allowing advisers to execute crypto trades for more of its clients.According to a Thursday report from Business Insider, retail wealth clients at JPMorgan now have access to cryptocurrency funds. A person directly familiar with the bank’s move to the digital space said all JPMorgan clients seeking investment advice — including those managed by financial advisers, retail....

Related News

Global investment bank JPMorgan has reportedly green-lighted its advisors to provide clients with access to five cryptocurrency funds. The funds are available to all JPMorgan’s wealth management clients seeking investment advice. The move makes JPMorgan the first large bank to expand crypto trading access beyond just ultra-wealthy clients. JPMorgan Now Offers Access to Crypto Funds JPMorgan has given its financial advisors the green light to give all its clients access to cryptocurrency funds, the Insider reported Thursday, citing people directly familiar with the matter. This move....

JPMorgan will reportedly give retail clients access to bitcoin investment vehicles starting on July 19, a first in U.S. big banking

One of the largest U.S. investment banks, Morgan Stanley, will be offering its wealth management clients access to bitcoin funds. Goldman Sachs, JPMorgan Chase, and Bank of America’s wealth management divisions do not currently allow their advisors to offer direct investment in bitcoin funds. Morgan Stanley to Offer Wealth Clients Access to Bitcoin Funds Investment bank Morgan Stanley, with $4 trillion in client assets, has become the “first big U.S. bank to offer its wealth management clients access to bitcoin funds,” CNBC reported Wednesday. The firm reportedly told its....

JPMorgan now offers access to six different crypto funds from GrayScale, Osprey Funds and NYDIG. JPMorgan Chase quietly opened up access to six crypto funds over the past three weeks as it looks to offer crypto exposure to a variety of clients. In the latest move, the bank’s private clients will now have access to a new Bitcoin fund created by crypto investment firm New York Digital Investment Group (NYDIG). NYDIG is owned by Stone Ridge Asset Management and the “Stone Ridge Bitcoin Strategy Fund” offers exposure to Bitcoin via futures markets. The NYDIG fund is in addition to five crypto....

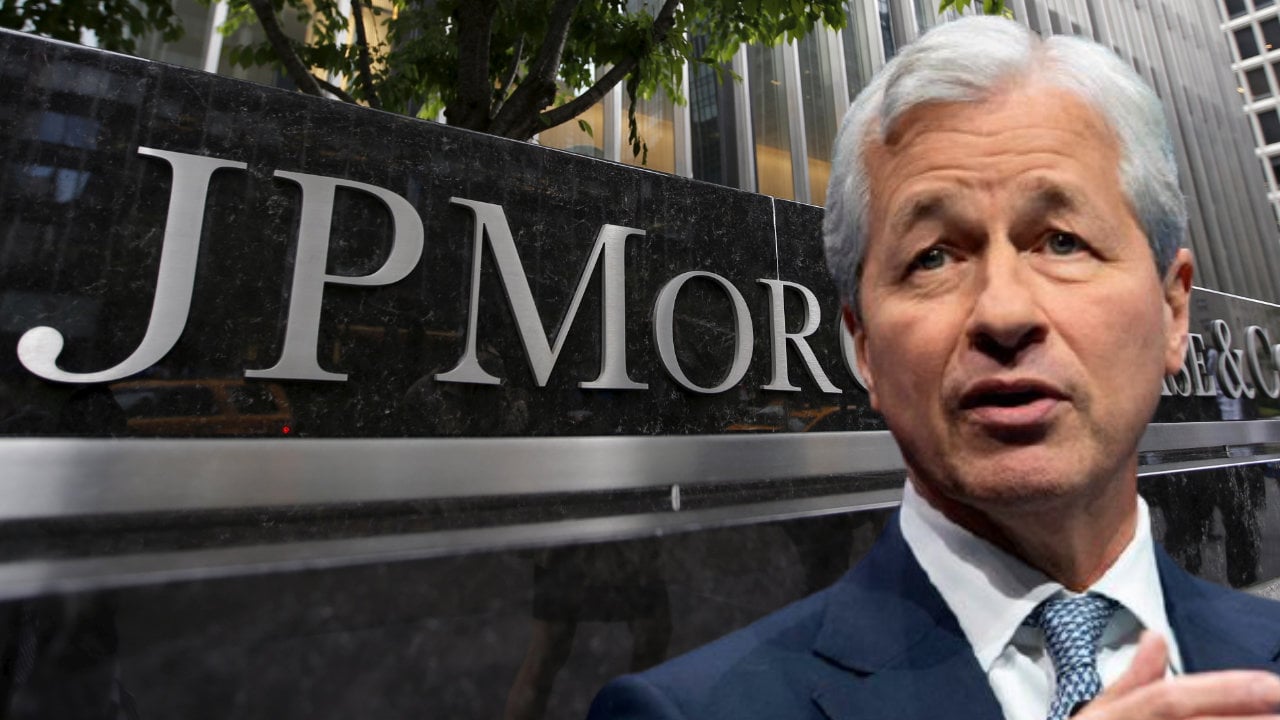

Global investment bank JPMorgan is now offering six cryptocurrency investment funds to clients despite its CEO, Jamie Dimon, continually advising against investing in bitcoin and other cryptocurrencies. JPMorgan Chase has quietly begun giving its wealth management clients access to six cryptocurrency investment funds, CNBC reported Thursday, citing people with knowledge of the move. On Thursday, the bank’s financial advisors were allowed to begin placing private bank clients into a new bitcoin fund created by crypto firm New York Digital Investment Group (NYDIG), a subsidiary of....