105 Countries Are Exploring Central Bank Digital Currencies, CBDC Tracker Shows

There are now 105 countries that are exploring central bank digital currencies (CBDCs). Among them, 50 countries are in an advanced phase of digital currency exploration (development, pilot, or launch). 105 Countries Are Exploring CBDCs The Atlantic Council’s Geoeconomic Centre has released a major update to its Central Bank Digital Currency (CBDC) Tracker. According to the tracker: 105 countries, representing over 95 percent of global GDP, are exploring a CBDC … A new high of 50 countries are in an advanced phase of exploration (development, pilot, or launch). Furthermore,....

Related News

Eighty-one countries are now exploring central bank digital currencies (CBDCs), according to a new tracker. This number is 46 more countries than the number in May last year. In addition, five countries have fully launched their own digital currencies. 81 Central Banks Explore Launching Own Digital Currencies The Atlantic Council’s Geoeconomics Center unveiled a new central bank digital currency (CBDC) tracker featuring an interactive database last week. The Geoeconomics Center described itself as “a nonpartisan organization that galvanizes U.S. leadership and engagement in the....

Governments around the world are pouring more resources into CBDC research and exploratory use cases. Among the major economies, China appears to be pulling ahead and has plans to implement digital-yuan usage during the 2022 Winter Olympics in Beijing. The quest to understand the opportunities and challenges of a central bank digital currency, or CBDC, is underway in 81 countries, with five nations fully implementing a digital version of their currency, according to a new tracker from the Atlantic Council. The Caribbean region is home to all five CBDCs that are currently in use, with The....

As central bank digital currencies (CBDCs) advance in testing, a number of countries have taken the lead in an effort to create a CBDC. The enterprise blockchain firm Guardtime recently conducted a survey that shows adults from ten different countries would likely use a CBDC. Nearly two out of three respondents said they would likely use a CBDC after launch and most of the study’s participants believe a major CBDC will be launched within three years. 63% of Survey Respondents Would Leverage a CBDC if Launched, 33% Would Be ‘Very Likely’ to Use a CBDC The enterprise....

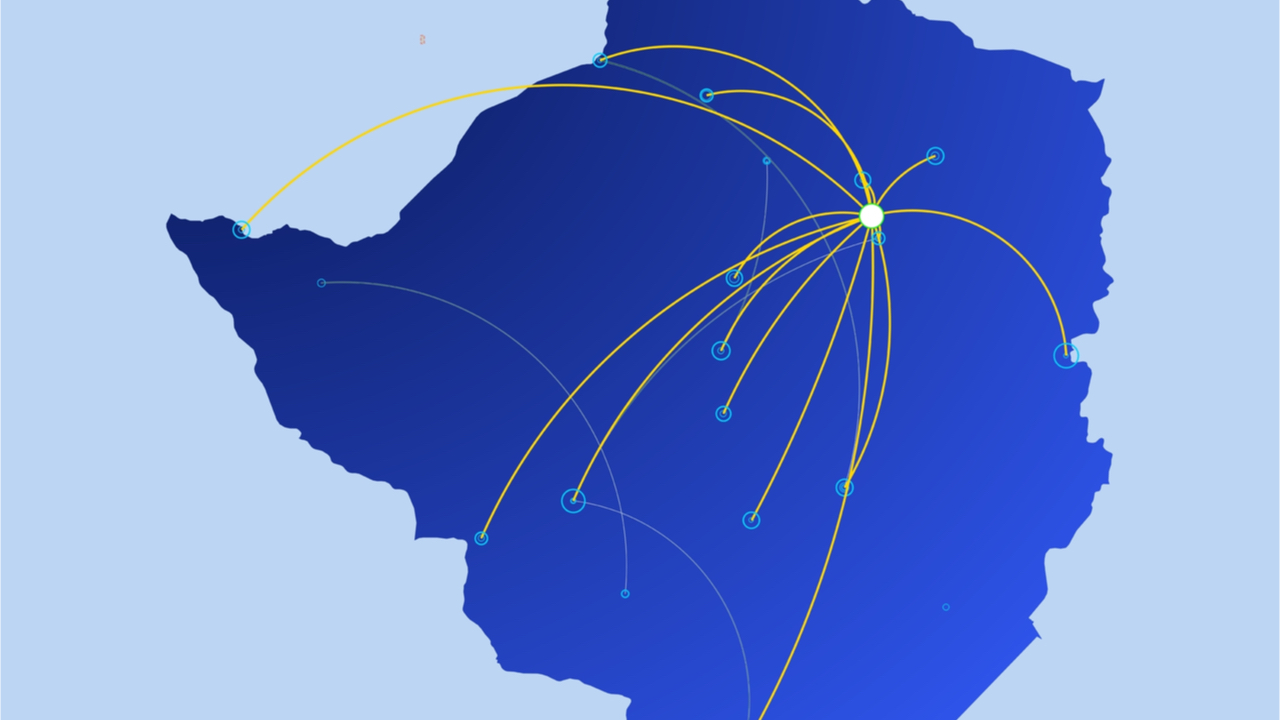

Zimbabwe’s central bank, which has expressed its opposition to cryptocurrencies in the past, announced yesterday it is presently exploring the feasibility of rolling out its own central bank digital currency (CBDC). The bank also said its regulatory sandbox continues to garner interest.

CBDC Roadmap

The Zimbabwean central bank, the Reserve Bank of Zimbabwe (RBZ), has reiterated that it prefers a central bank digital currency (CBDC) to cryptocurrencies, in its latest monetary policy statement. It adds it is now “actively exploring the feasibility of adopting a....

The central bank has “already begun preparations” for a digital shilling, according to Bank of Tanzania Governor Florens Luoga. The Bank of Tanzania is reportedly planning to introduce a central bank digital currency, or CBDC, for the African nation after neighboring countries announced similar initiatives.According to a Friday Bloomberg report, Bank of Tanzania Governor Florens Luoga said on Thursday that Tanzania was planning to follow Nigeria’s example in rolling out its own CBDC. Luoga reportedly said that the central bank had “already begun preparations” for a digital shilling,....