Fed Expects 2 Rate Hikes in 2023, Stock Market Plunges, Powell Anticipates Hi...

The Federal Reserve on Wednesday told the public that it has forwarded the time frame for raising interest rates. “Progress on vaccinations will likely continue to reduce the effects of the public health crisis on the economy, but risks to the economic outlook remain,” the Federal Open Market Committee (FOMC) said in a statement. The Meeting Before the ‘Meeting’ – Fed Expects Two Rate Hikes in 2023 After a number of market players waited for the Federal Reserve to reveal some signals, they got some on June 16, when 13 of the FOMC’s 18 committee members....

Related News

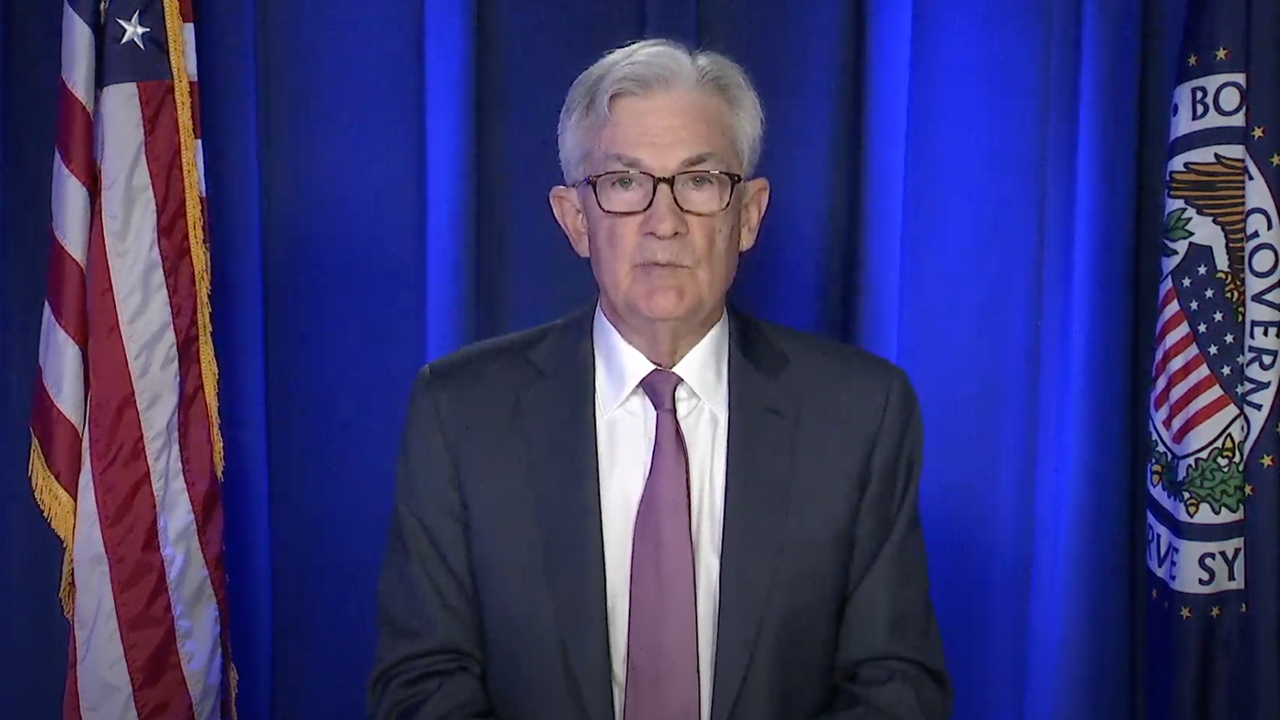

On Wednesday, the Federal Open Market Committee (FOMC) and Fed chair Jerome Powell held a press conference concerning the American economy, the central bank’s plans to address inflation, and the ongoing Russia-Ukraine war. Powell announced that the FOMC decided to increase the benchmark bank rate by a quarter percentage point and further noted the Fed anticipates “ongoing increases…will be appropriate.” Federal Reserve Increases Benchmark Bank Rate For the first time since the onset of the Covid-19 pandemic, the Federal Reserve announced that it increased the....

Federal Reserve chairman Jerome Powell still expects to see interest rate hikes starting in March, but the Fed chief further stressed that the central bank will “need to be nimble.” In remarks prepared for members of U.S. Congress, Powell discussed the Russian invasion of Ukraine, noting that the “implications for the U.S. economy are highly uncertain” and the Fed “will be monitoring the situation closely.” US Central Bank Plans to Make ‘Appropriate Monetary Policy’ in This Uncertain Environment The warfare in Ukraine has added a....

Stock markets and Bitcoin price took a slight hit after the Federal Reserve announced plans to increase interest rates twice in 2023, a tad bit earlier than markets expected. Bitcoin dropped closer to a key support level and the Dow and the S&P 500 pulled back after the Federal Reserve moved forward its plan for 2 interest rate hikes in 2023.Bitcoin (BTC) price extended its losses shortly after Federal Reserve Chair Jerome Powell announced that the Fed would move forward its timeline and schedule two interest rate hikes in 2023. Bitcoin price was already seeing weakness in the early....

Federal Reserve Chairman Jerome Powell says that it is “very premature” to think about pausing rate hikes. “We have a ways to go,” he stressed. However, economist Peter Schiff warned that “Planned rate hikes and QT will only succeed in crashing the economy, not bringing down inflation.” Fed Chair Powell Says ‘Very Premature’ to Talk About Pausing Interest Rate Hikes Fed Chairman Jerome Powell clarified during a news conference on the central bank’s economic outlook Wednesday that the Fed is not thinking about pausing its rate hikes. The....

Jerome Powell is lengthening economic pain by refusing to raise interest rates at the necessary pace. It’s time to rip off the band-aid. Can we all agree that the Federal Reserve has a plan to combat runaway inflation? They do. Chair Jerome Powell has all but admitted it. After tempering his comments before previous rate hikes, allowing wiggle room which gave way to market rebounds, Powell has left no bones about this one. It is necessary to wreak some havoc on the economy and put downward pressure on the labor markets and wage increases to stop the creep of inflation. Whether you buy into....