XRP Daily New Addresses Plunge 80% In 2025 — Bearish On-Chain Metrics Raise A...

Crypto education and media platform Coin Bureau has shared some puzzling developments on the XRP market that may hint at a prolonged bearish future. Notably, the altcoin has been a major headliner amidst a general crypto market correction in the past one month. During this period, XRP prices have dipped by over 10% with current market prices around $2.13. While crypto enthusiasts remain hopeful of market resurgence, Coin Bureau’s recent revelations shows that on-chain data suggests otherwise. Related Reading: Consolidation Takes Its Toll: Bitcoin Investors No Longer Greedy XRP $3 Target....

Related News

Fantom network was able to log more than 300,000 active weekly users which is a 4% decrease from the 325,000 users tracked the past week. Fantom treads the bearish route as negatively impacted by the crash of the crypto market FTM social metrics down Fantom records over 300,000 active weekly users The bears are definitely lobbying on Fantom (FTM) as the coin endures massive decline. Fantom admits that they have been severed by the bearish impact of the crypto market triggering a plunge. More so, average daily transactions on Fantom from August 11 to 18 accumulated to roughly 44,300.....

XRP’s on-chain metrics are reportedly painting a foreboding picture for its price outlook, as data shows a steep 80% decline in new wallet creation over the past five months. This drop in network activity has sparked divided opinions between two expert analysts, with one casting doubts on XRP’s ability to reclaim the $3 mark, and the other rejecting such bearish predictions. XRP Price Surge To $3 Stalled In a recent X (formerly Twitter) post, crypto analyst the ‘Coin Bureau’ highlights that XRP’s momentum appears to be fading fast as new on-chain data from Glassnode reveals a staggering....

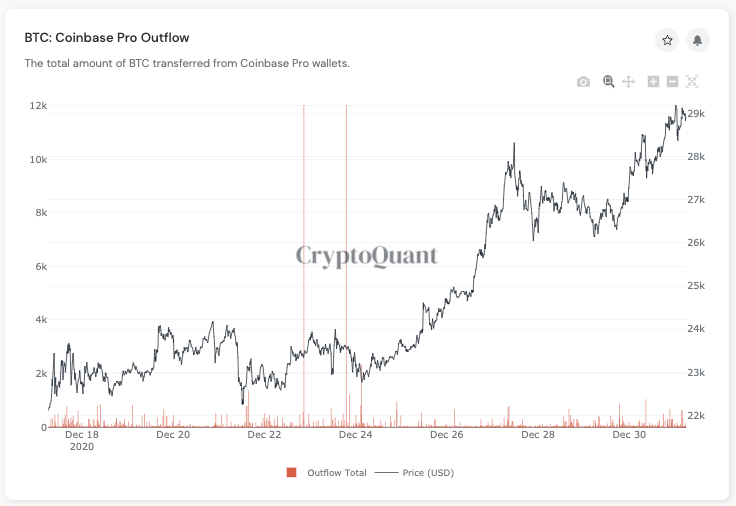

Bitcoin faces the prospects of undergoing a massive downside correction as on-chain data shows a plunge in its over-the-counter deals. According to data fetched by CryptoQuant, the total amount of Bitcoin tokens flowing out of Coinbase Pro’s addresses to their newly-created custodial cold wallets has decreased ever since BTC/USD crossed above $23,000. Coinbase Pro Bitcoin […]

Bitcoin on-chain analysis is showing more short-term holders registering losses, and they are statistically more likely to sell according to Glassnode. Blockchain analytics provider Glassnode has depicted a bearish scenario for Bitcoin as on-chain metrics suggest increased selling pressure is imminent.In its weekly analytics report on Feb. 21, on-chain metrics firm Glassnode said that Bitcoin bulls “face a number of headwinds,” referring to increasingly bearish network data.The researchers pointed at the general weakness in mainstream markets alongside wider geopolitical issues as the....

BNB Chain has shown strong performance over the last week, with the ecosystem holding key metrics despite the recent market downturn and BNB’s price correction toward a major support level. Related Reading: Crypto Market Crash ‘Worse Than Expected’ But Bottom Might Be Near, Says Tom Lee BNB Chain Key Metrics Hold Strong On Monday, BNB Chain shared its weekly ecosystem snapshot, revealing solid network performance and sustained growth on multiple key metrics from January 22 to January 28, 2026. According to the report, BNB Chain saw over 4.9 million average Daily Active Users (DAU) during....