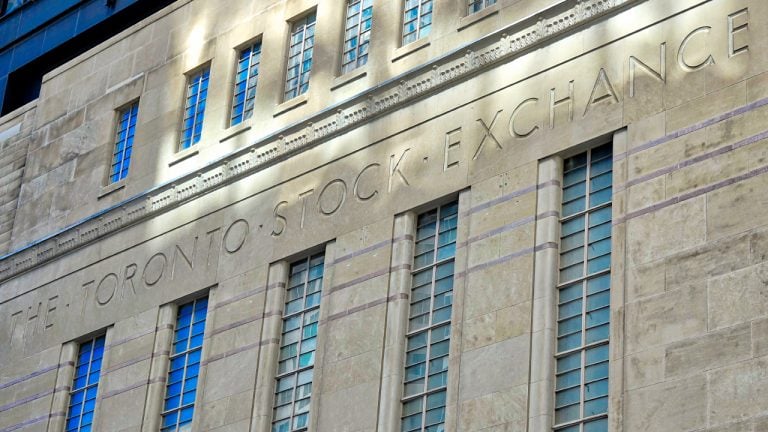

Bitcoin Fund Debuts on Canada’s Biggest Stock Exchange

CI Global Asset Management has begun to trade on the Toronto Stock Exchange in Canada. The fund’s initial public offering managed to raise $72 million and units commenced trading in both U.S. dollars and Canadian dollars. CI Global Fund Begins Trading CI Global Asset Management has made it known that it has completed the initial public offering of the CI Galaxy Bitcoin Fund. According to the press release, $72 million was raised from the listing. Initially, the fund had different classes such as class A, class C, and class F. However, regardless of their class, each share unit was....

Related News

Digital asset investment managers 3iQ introduced ETH market exposure to Canada’s stock traders and investors on Thursday. The world’s first Ethereum-based fund to be listed on a major stock exchange opened for trading on Thursday, but not without some hiccups. Listed on the Toronto Stock Exchange, The Ether Fund (TSX:QETH.U) opened for trading at $10.80 per share after completing a successful IPO in which $76.5 million was raised.Now available in brokerage and registered retirement accounts....... The Ether Fund (TSX:QETH.U) is the world's first regulated and major exchange-listed ETH....

Shares of Canada’s first publicly listed Bitcoin fund are up 30% since its launch in April. Canadian digital asset manager 3iQ has recorded a major milestone fo its public Bitcoin (BTC) fund.The Bitcoin Fund — Canada’s first Bitcoin fund listed on a major stock exchange — has crossed the $100 million market cap threshold, 3iQ announced in an Oct. 20 tweet.Tyler Winklevoss, a major cryptocurrency investor and a co-founder of United States’ Gemini crypto exchange, congratulated 3iQ on the milestone.Big Milestone. The #Bitcoin Fund by @3iq_corp that trades publicly on the Toronto Stock....

The Ontario Securities Commission (OSC) has granted Purpose Investments Inc. the approval to launch a spot XRP exchange-traded fund (ETF) on the Toronto Stock Exchange (TSX). This particular ETF will offer CAD-hedged, CAD non-hedged, and US dollar XRP products from June 18 onwards. Interestingly enough, Purpose Investments is the same financial entity that launched the […]

3iQ’s Bitcoin QBTC fund has surged 900% in market cap since October 2020, breaking a $1 billion milestone. Canadian regulated digital asset manager 3iQ has recorded another massive milestone of its public Bitcoin (BTC) fund.On Jan. 14, 3iQ’s Bitcoin Fund (QBTC) hit the $1 billion mark, the company announced on Twitter. The new milestone demonstrates QBTC’s parabolic growth after 3iQ launched the fund in April 2020. QBTC is now up 900% from its previous milestone of $100,000 recorded in October 2020.As previously reported, 3iQ’s QBTC is Canada's first public Bitcoin fund listed on a major....

The Gibraltar Stock Exchange said Tuesday that it listed a new bitcoin fund belonging to 3iQ Corp, a Canadian investment fund manager that focuses on new technologies and crypto assets. The announcement follows GSX Group’s recent launch of what it calls the Grid, “a venue to create and deploy debt securities, funds, and equities as ‘smart securities’ in tokenised form”. GSX is the parent company of the Gibraltar Stock Exchange. According to the exchange, the newly listed fund tracks the price of bitcoin by using a special index feed, which was developed by....