Binance’s Bitcoin Dominance Sharply Rises, Now Holds 22.6% Of Total Exchange ...

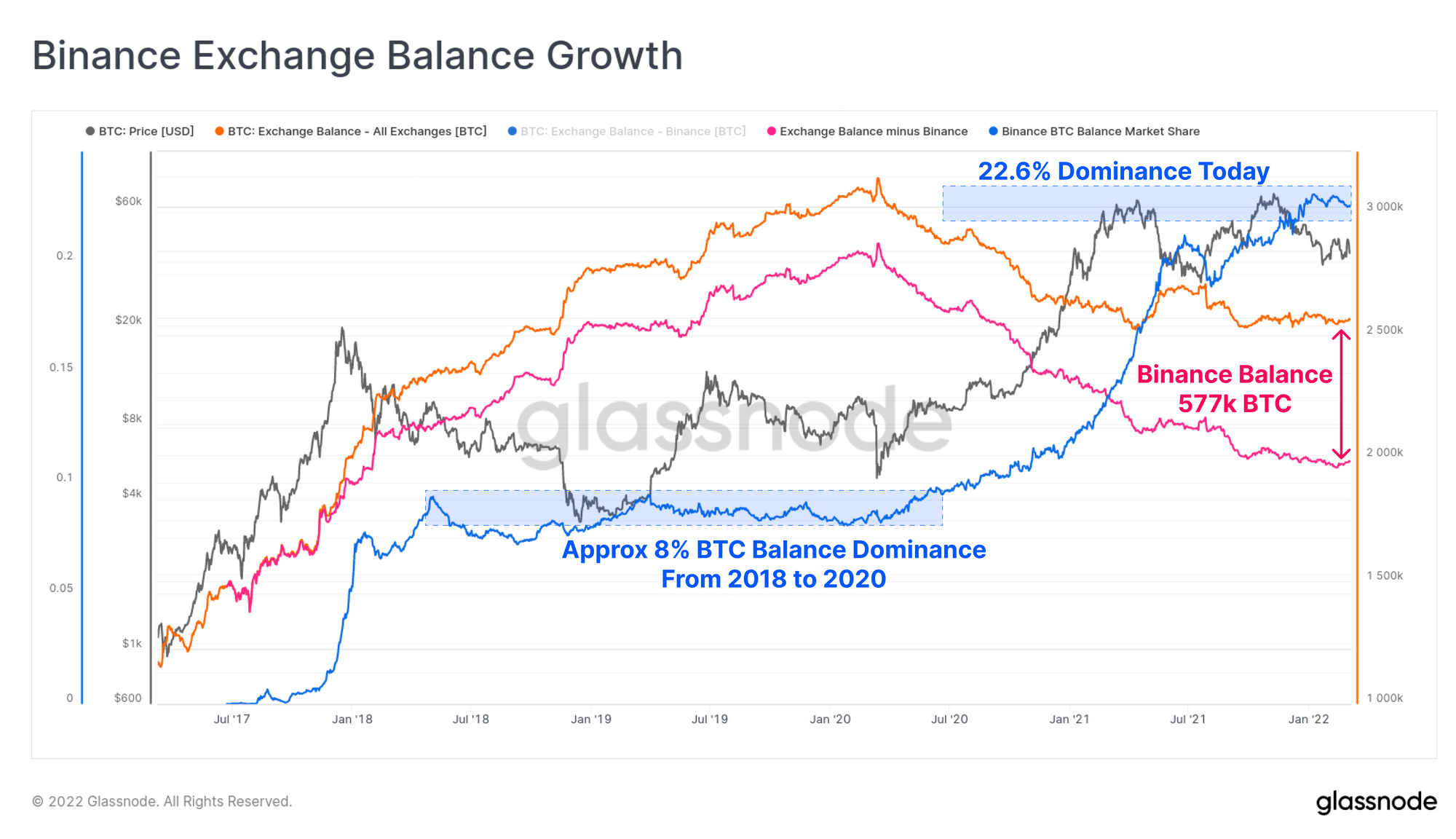

On-chain data suggests Binance has seen some sharp growth in its Bitcoin dominance over the past couple of years, leading to the crypto exchange now holding more than 22% of the total reserve. Binance Observes Growth Of 120% In Bitcoin Balance In Just The Last 2 Years According to the latest weekly report from Glassnode, […]

Related News

BTC dominance has always had an inverse effect on the price movements for altcoins. Historically, BTC dominance determines the direction the value of altcoins swings in. Bitcoin has so far maintained majority dominance on the market. But as more time passes, that dominance goes down as altcoins see more demand. BTC dominance simply shows how much demand there is for bitcoin compared to altcoins. The more BTC dominance rises, the lower the demand for altcoins. This means that for altcoins to rally up further, bitcoin demand has to go down. Related Reading | Ethereum Breaks 200,000....

BTC.D rises in price as altcoins suffer a bloody day in crypto. BTC.D attempts to break out above 8, and 20-day Exponential Moving Averages as altcoins struggle to hold their key support. The price of BTC.D eyes a rally to 48% as this could mean more pain for altcoins. Many altcoins have experienced a relief bounce across the market as Bitcoin Dominance (BTC.D) remains below the 40% marked area allowing altcoins to rally when the market recovers. With Bitcoin Dominance (BTC.D) rising from the ashes, we could see the price of altcoins suffering more pain than expected if the price....

Both retail and institutional adoption and interest in Bitcoin continue to see notable growth following the recent price upswing over the past week, which has led to a huge rise in BTC’s dominance over other cryptocurrency assets in the market. Bitcoin’s Market Dominance Almost Over With Bitcoin persistently witnessing a significant price rally, its dominance […]

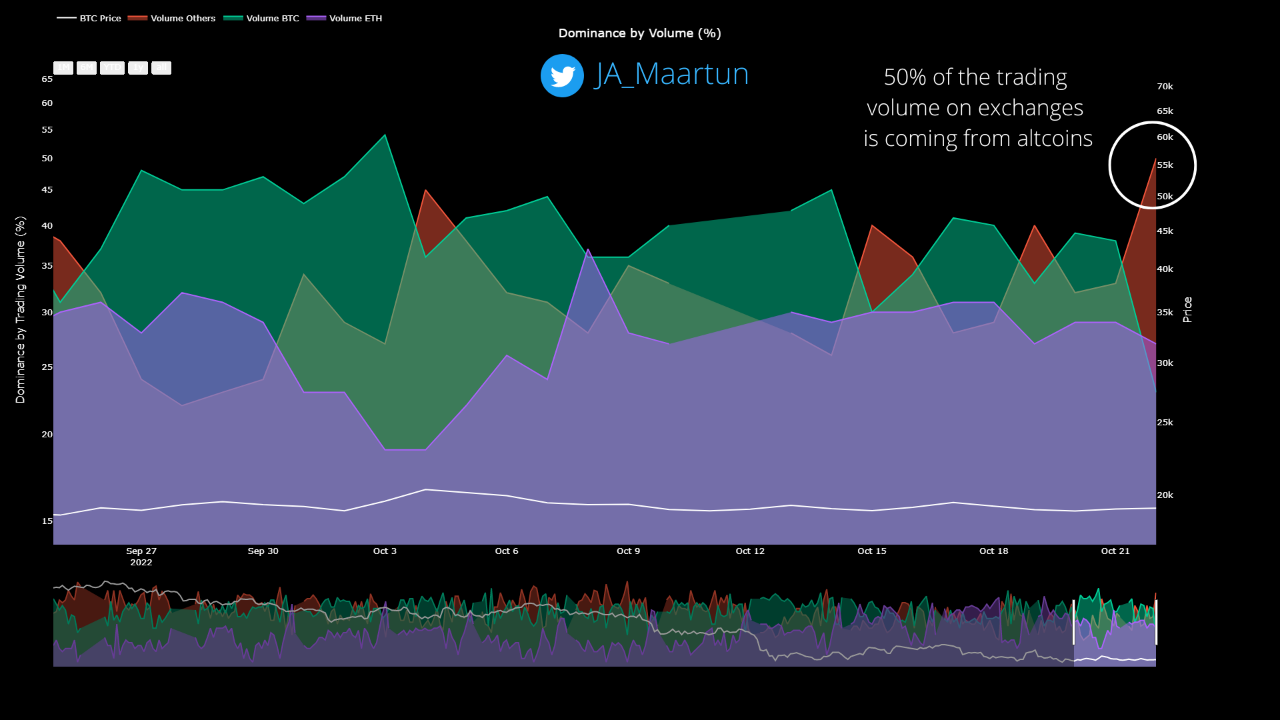

Data shows the altcoin dominance by volume on exchanges has now risen to 50%, here’s what happened to Bitcoin the last two times the crypto market saw such a shift. Altcoins Are Now Contributing To 50% Of The Volumes On Exchanges As pointed out by an analyst in a CryptoQuant post, altcoins have started to dominate after Bitcoin was number one for an entire month. The relevant indicator here is the “trading volume,” which is a measure of the total amount of coins being traded on centralized exchanges. The percentage to this total trading volume being contributed by an....

In a recent trend evident on crypto charts, Bitcoin dominance is once again on the rise, prompting some traders and investors to rethink their strategies concerning altcoins. An in-depth analysis of the data, coupled with insights from prominent crypto analysts, unveils several compelling reasons to exercise caution when considering an altcoin purchase at this moment. Historical Precedence Bitcoin’s market dominance – its market cap relative to the entire cryptocurrency market – has historically been a leading indicator of market sentiment. If Bitcoin dominance is increasing, it....