Reputation DAO: Would you give up privacy for unsecured loans in DeFi?

The platform intends on leveraging users’ personal financial information such as credit score and AML/KYC to help reduce the collateral needed to take out a DeFi loan. An ambitious new decentralized autonomous organization (DAO) has built a data service for lending platforms that records a user’s financial reputation to reduce the amount of collateral needed for a loan.It has partnered with Chainlink and that protocol’s founder Sergey Nazarov is an early backer.Users of Reputation DAO will have traditional financial data such as anti-money laundering and know-your-customer (AML/KYC),....

Related News

Arcx has launched a new version of its “DeFi Passport,” Sapphire, promising the pseudonymous on-chain credit check will enable new decentralized finance products. Decentralized finance (DeFi) protocol Arcx has announced the launch of Sapphire v3, a DeFi passport allowing crypto users to pseudonymously build and verify their reputation on-chain.Announced June 2, the DeFi passport will score users on a scale between 0 and 1,000, with Arcx advancing that the passport “incentivizes reputation-building and curates on-chain identity into DeFi.”In the absence of a DeFi passport, Arcx asserts that....

Decentralized finance otherwise known as defi has climbed significantly in value this year, as the total value locked (TVL) in defi today is over $14 billion. Meanwhile, numerous defi platforms are getting attacked with flash loans and there are so many new defi projects, it’s hard to keep track of them all. Moreover, while many defi supporters claim these platforms offer greater privacy, examples now show that most everything can be seen onchain connecting ethereum addresses to identities and companies. Exploits and Flash Loans Are Becoming Commonplace in the Land of Decentralized....

The dream of every borrower is to get loans without collateral and Flash loans in DeFi allow you to fulfill that dream. If you’ve been denied a loan application for lack of security, you’ll understand the accompanying frustrations. Some of the traditional financial institutions can be hardcore when it comes to loans. But who needs […]

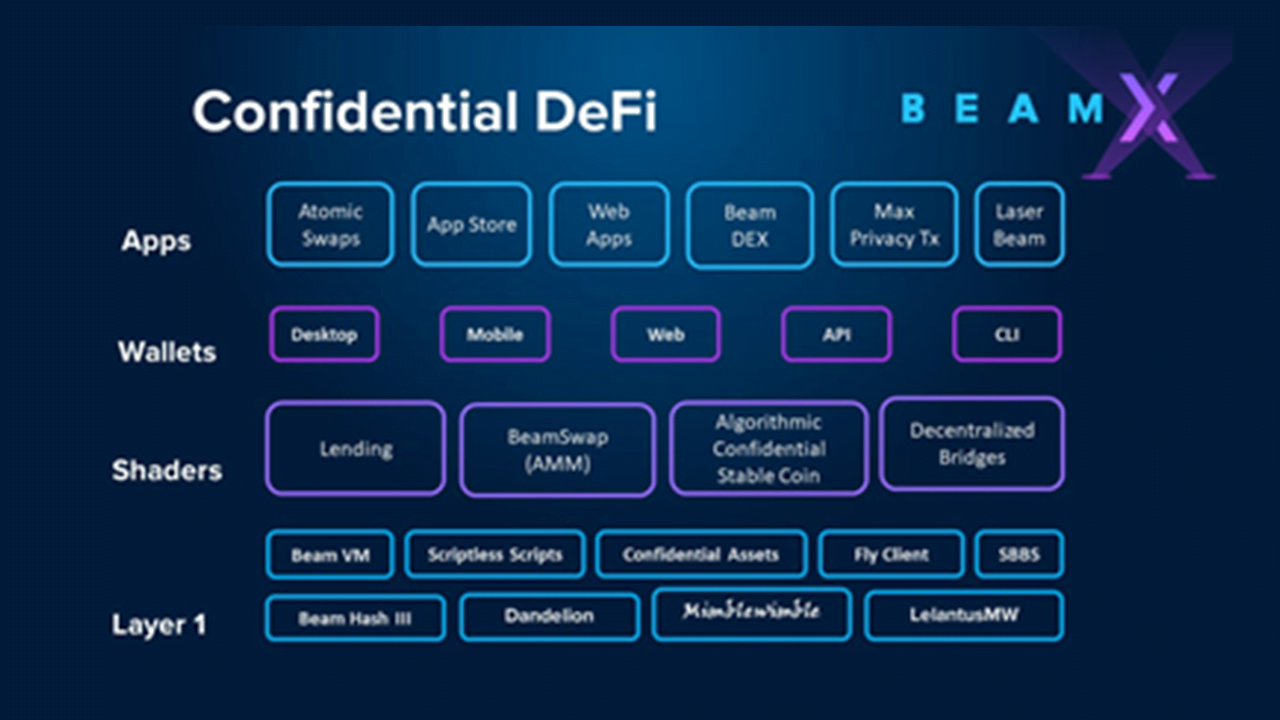

Beam, the crypto project utilizing Mimblewimble privacy tech, has announced the imminent launch of a confidential defi network called BeamX. Almost two years on from its mainnet launch, the privacy coin is moving into the defi sector to enable the creation of dApps that are user-friendly and privacy-centric, citing flaws inherent in the Ethereum ecosystem. […]

The privacy-focused Oasis Network has completed its mainnet launch, promising to facilitate under-collateralized loans in DeFi. Oasis Labs has announced the successful launch of its Oasis Network mainnet, with more than 70 independent validators already live.Oasis is a privacy focused Layer 1 network that claims a throughput of 1000 transactions per second designed to support decentralized applications. In June 2018, Oasis raised $45 million from crypto venture heavyweights including A16z, Binance Labs, Pantera, and Polychain. Oasis allows data to be encrypted, and for privacy policies....