Bitcoin Miner Fees Remain Near Cycle Lows: What Does This Signal?

Bitcoin has slipped below the $83,000 level as selling pressure continues to dominate global markets, extending a correction that has unfolded alongside broader risk-off conditions. Weakness across equities and commodities has weighed on investor sentiment, and Bitcoin has not been immune to this environment. With volatility elevated and liquidity thinning, market participants are increasingly cautious, and several analysts now point to the possibility of a deeper retracement toward lower demand zones before any meaningful stabilization can occur. Related Reading: XRP Risk-Adjusted Returns....

Related News

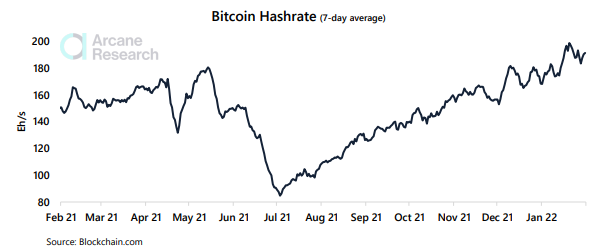

On-chain data shows Bitcoin miner revenues have now declined to six-month lows as the price of the crypto has continued to struggle recently. Bitcoin Miner Revenues Fall To 6-Month Lows As per the latest weekly report from Arcane Research, the BTC miner revenues have now dropped to lows not seen since six months ago. Over […]

The XRP price began the week with a show of bullish momentum, seeing an approximate jump of 7%. However, the altcoin could not continue on this trajectory, as it nosedived on Wednesday and continues on that downward trajectory. While XRP’s future appears to tilt towards the bearish side, a technical indicator has recently revealed that the token may be setting up for a short-term rebound. Related Reading: Bitcoin Miner Fees Remain Near Cycle Lows: What Does This Signal? TD Sequential Signals Potential Trend Exhaustion In an X post on January 30, technical analyst Ali Martinez....

Bitcoin miner revenues have been in decline since the bear trend began and this has led a good number of miners to sell their BTC holdings in order to keep their operations afloat. However, the expectation that the bear market would soon resolve and miners would once again be in the green has since gone out the window. With miner revenues continuing to plummet, miners may have to resume selling off their holdings to keep up with the market. Miner Revenues Fall For the past week, there has been no change in the downtrend in miner revenues. On-chain metrics show that it was down 0.59% from....

Data shows that the last time the Ethereum transaction fees dipped towards lows this deep, the cryptocurrency’s price reached its bottom. Ethereum Average Transaction Fees Has Dropped To Just $1.13 Now According to data from the on-chain analytics firm Santiment, the cryptocurrency has observed particularly low fees this week. The “average fees” here refers to […]

Bitcoin miner revenues have been a hot topic of discussion in the last three months. It mainly follows the decline in cash flow of mining machines due to the drop in the price of BTC, and that has adversely affected the revenues of bitcoin miners, seeing them drop to yearly lows. However, as the market has recovered some of its lost value, bitcoin miners are starting to fare better in terms of revenues, which could be the plug to the recent sell-offs. Miner Revenues Grow Bitcoin daily miner revenues had dropped to the $17 million level during the lowest point. At this time, bitcoin miner....