3 reasons why analysts are turning bullish on Curve Finance (CRV)

Attractive yields for stakers, protocol revenue and competition among DeFi protocols have analysts pointing to a bullish long-term view for Curve Finance. Choppy markets after a major pullback offer ample time to take a survey of the cryptocurrency landscape and find solid projects with improving fundamentals that have caught the attention of analysts and tokenholders. One project that has piqued the interest of many, including researchers at Delphi Digital, is Curve Finance, a decentralized exchange for stablecoins that focuses on providing on-chain liquidity using advanced bonding....

Related News

Following the recent Curve Finance attack, Binance CEO Changpeng Zhao announced that the exchange had recovered $450 million from hackers. The decentralized finance (defi) platform Curve saw roughly $570 million siphoned from the application on August 9. Binance Boss Says Exchange Froze 83% of the Curve Finance Hack Funds, Domain Provider Says Exploit Was DNS Cache Poisoning Four days ago, the crypto community was made aware that the Curve Finance front end was exploited. Curve fixed the situation but $570 million was removed from the defi protocol. The attackers, however, decided to send....

Curve Finance community members are already voting to terminate CRV releases from all UST liquidity pools. Curve Finance, an innovative crypto project, announced on Thursday morning that it would end all connections with the UST stablecoin. The platform took to Twitter, announcing how it’d be terminating its deal with the recently-crashed stablecoin, UST. This move […]

Reports indicate that the decentralized finance (defi) protocol Curve was hacked for $570,000 in ethereum after people noticed that Curve’s front end was exploited. The attackers then tried to launder the funds via the crypto exchange Fixedfloat, and the trading platform’s team managed to freeze $200K worth of the stolen funds. Curve Finance Exploited for $570K — Fixedfloat Exchange Freezes More Than $200K, Domain Service Blamed Another defi hack was discovered on August 9, when the Paradigm researcher Samczsun tweeted that Curve Finance’s frontend was....

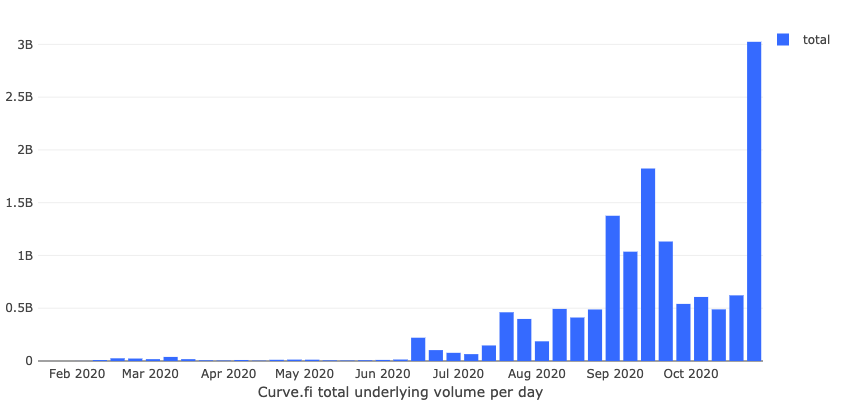

The price of Curve Finance’s governance token CRV spiked by more than 100 percent as the decentralized exchange (DEX) experienced a massive surge in trade volume. Earnings Curve Finance processed about $2.8 billion worth of trades on Monday, almost 450 percent higher than its previous record high in September 2020. The jump in its trade […]

Crypto friendly regulations, rising user activity and a recent collaboration with Yearn finance back Curve DAO Token’s recent triple-digit rally. Over the past two weeks the entire DeFi sector has been in a strong uptrend and many of the top market cap tokens rallied by double and triple-digits.Curve DAO’s governance token CRV has been a standout performer, coming off a low at $0.54 on Jan. 11 to a 2021 high at $1.78 on Jan. 17. CRV/USDT 4-hour chart. Source: TradingviewThree reasons for this latest surge in volume and price for CRV are a new collaboration with the Yearn.finance (YFI)....