Bitcoin’s Latest Casualty: Miner Reserves Plunge to 3-Year Low, What’s Next F...

Amid Bitcoin (BTC) continuous struggle for a major rally to new heights, miners powering the Bitcoin network are experiencing significant economic shifts. Particularly, recent data shows a stark reduction in Bitcoin reserves held by miners, signaling potential shifts in market stance or miner strategies. Related Reading: $0 Flows: BlackRock Unshaken Despite Recent Bitcoin Market Crash, Data Shows Bitcoin Miner Reserves: A Plunge To 3-Year Low Following the latest Bitcoin Halving—an event that reduced the block rewards miners earn for their computational efforts—which occurred back in....

Related News

Bitcoin is experiencing a challenging period, with its price remaining below the $100,000 mark after a significant drop earlier this week. Today, Bitcoin hovers just above $98,000, marking a nearly 10% decline from its all-time high of over $109,000 recorded last month. Interestingly, while BTC’s price has slowed, its exchange reserve has faced the same fate, with data showing a continuous decline from this metric. Related Reading: 49,700 Dormant Bitcoin Just Moved—What’s Next For BTC’s Price? Does This Suggest An Incoming Rebound For Bitcoin? ShayanBTC, one contributor to the....

On-chain analysis shows Bitcoin miner reserves seem to be closing in on the ATH seen in May, as the BTC bull rally continues. Bitcoin Miner Reserves Reach Close To May ATH Levels As pointed out by a CryptoQuant post, the BTC miner reserves seem to be on the rise, and look to be close to the levels seen during the 9 May all-time-high (ATH). The BTC miner reserves is an indicator that shows how many coins miners are holding in their wallets. More the value of this metric, less the selling pressure for miners in the market. Related Reading | S2F Creator Beckons Beginning Of Second Leg Of....

Data shows the Bitcoin miner reserves have continued to trend downwards recently, suggesting that miners have been dumping their coins. Bitcoin Miners Have Been Withdrawing From Their Wallets In Recent Days As pointed out by an analyst in a CryptoQuant post, BTC miner reserves have been observing negative change recently, something that could lead to a decline in the price of the crypto. The “miner reserves” is an indicator that measures the total amount of Bitcoin currently present in the wallets of all miners. When the value of this metric goes up, it means miners are....

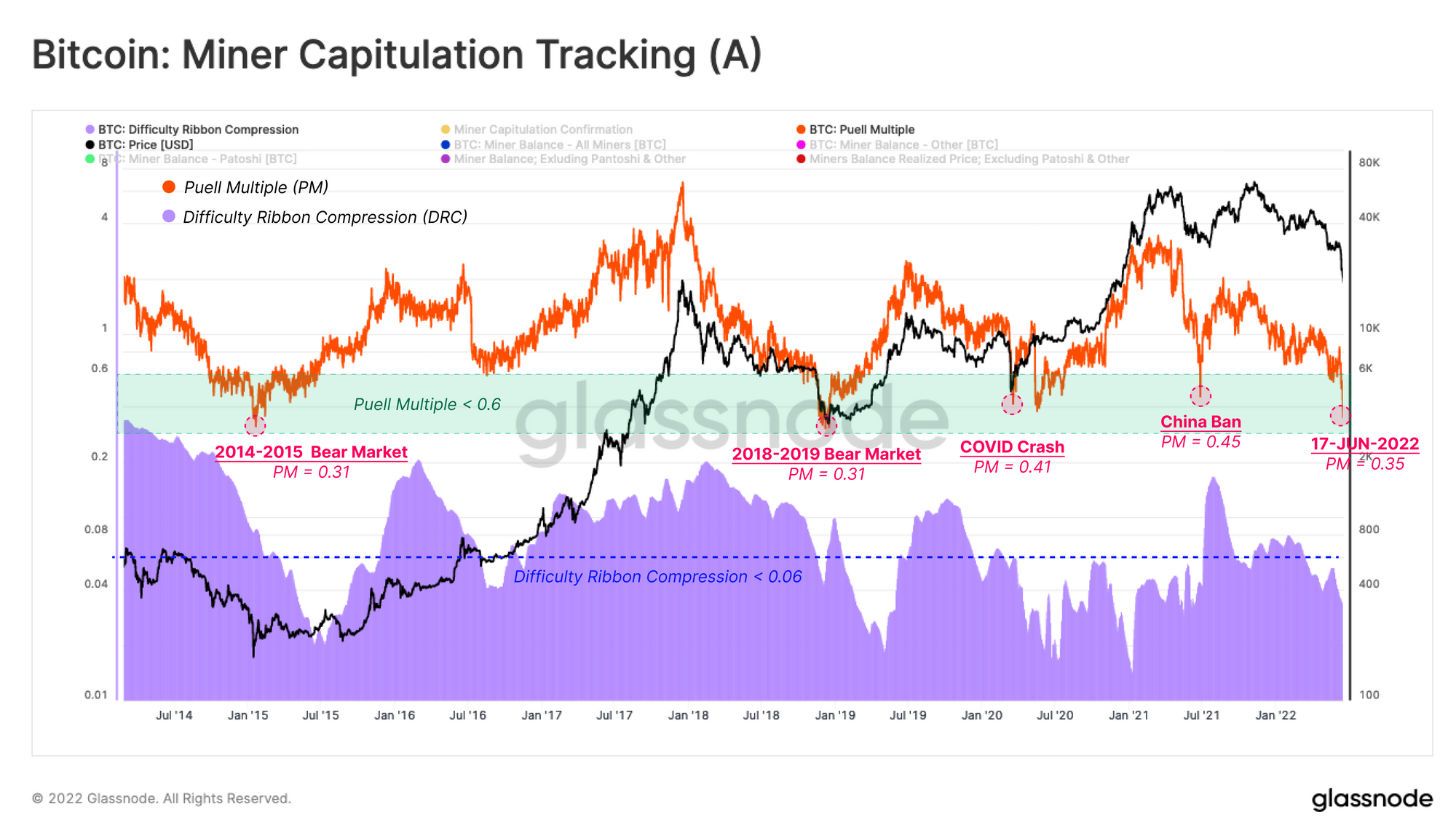

Data shows Bitcoin miner revenues have been coming under stress recently as they are now making 61% less than the average during the last year. Bitcoin Miner Revenues Come Under Pressure As Puell Multiple Sharply Drops As per the latest weekly report from Glassnode, the miner income contraction right now is greater than during the […]

Recent data from CryptoQuant has highlighted a significant shift in Bitcoin Miners behavior, with miner reserves dropping to their lowest levels since 2010 while over-the-counter (OTC) selling activity has surged to higher levels. What This Means For BTC At the beginning of the year, miner reserves stood at approximately 1.87 million BTC but have yet to grow to about 1.81 million BTC today, a level not seen since 2010. This reserve decline is notable as it indicates a higher propensity for miners to sell off their holdings. Typically, this could lead to increased market supply and....