Haasbot 2.2 Pushes the Boundaries of Cryptocurrency Trading Automation Innovation

Haasbot 2.2 introduces a host of new and innovative features to cryptocurrency trading automation, such as candlestick pattern recognition, new insurance types that automatically determine market conditions, adding a deviation offset to all indicators, Master Indicator feature, a completely redesigned marketview page, intregration with OKCoin, BTCChina, Coinbase, 14 new technical analysis indicators, and the introduction of fully programmable Script Bots!

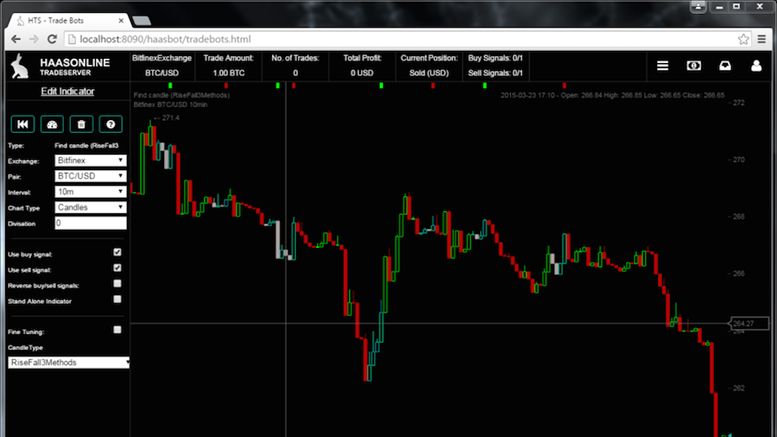

Haasbot 2.2 introduces a host of new features and functions that greatly increases the options for cryptocurrency trading automation for traders. The first big new innovative feature that is currently only available in Haasbot is candlestick pattern recognition. Candlestick pattern recognition is offered as an indicator for Trade Bots and can be viewed in the Marketview Page. The candlestick pattern recognition feature works by allowing a user to select one of the over 50 new candlestick patterns and the user can allow the candlestick pattern to execute trades based on when these patterns appear on any time period. This provides a new way to generate trade signals and they can be used in conjunction with any of our technical analysis indicators to produce even stronger trade signals.

Trend Identification Insurances

This new release also introduces new insurance types that will automatically identify trends. These new insurances can be set so that a trade bot will only execute trades when the selected trend is present with the current market conditions. For example, say a user wants to only trade on the RSI indicator during a sideways market. They simply can set up the RSI indicator to their preferences and select the “Sideways Trend” Insurance and the trade bot will only execute trades when the market is sideways. This allows traders to set up their trade bots ahead of time and let them run as the market trends change. This new feature provides a new element that makes Haasbot’s trade bots dynamic. Additionally, there are three variations of Volatile and Sideways market trends, so users can experiment and see which one suits their needs.

More Supported Exchanges

This version of Haasbot increases the number of exchanges that a user can trade on. The new additions are Okcoin.com (spot trading only at this time), OKCoin.cn, BTCChina, and Coinbase. Overall, Haasbot can trade on 12 different exchanges with over 800 cryptocurrency markets across all of the exchanges. Users can even monitor another exchange and execute trades on the exchange they mainly trade on.

Fine Tuning and the Deviation Offset

Haasbot 2.2 introduces fine tuning and even more control with the deviation offset. The deviation offset allows a user to delay trade signals from an indicator or candlestick pattern so that they can line it up with other indicators for the strongest trades. For instance, if the user determines that the 30 minute MACD-Histogram is signaling a candle or two too early, they can change that by adding a value to the deviation offset. This is also incredibly useful with the new candlestick pattern indicators.

Master Indicator Setting and new Indicators Added

Master Indicator is a new setting that allows users to further customize their trading strategies. The Master Indicator setting allows the indicator to execute trades without having to agree on other indicators. Currently, if a user has two or more indicators within a trade bot, all of the indicators must agree on a Buy or Sell signal for that trade to go through, but Master Indicators do not rely on other indicators. In addition to the Master Indicator setting, Haasbot 2.2 includes 14 new indicators, which are Connor’s RSI, Up Down RSI, Awesome Oscillator, Keltner Channels, Donchian Channels, Willians %R, Bollinger Bands %B, Chande Momentum Oscillator (CMO), Balance of Power (BOP), TRIX, TRIMA, KAMA, Fractals, and Small Fractals. Overall, Haasbot 2.2 supports 54 different technical analysis indicators.

Redesigned Marketview Page

The Marketview Page has been completely redesigned to function as a user’s very own personal trading platform. The marketview page now has 24 different drawing tools for charting and technical analysis, live charts for the exchanges a user is connected to, as well as dual view and quad view, indicators, candlestick patterns, and the ability to execute manual trades straight from this tab without logging in to an exchange. Haasbot 2.2 bridges the gap between a cryptocurrency trading platform and automation software.

Introducing Script Bots

Haasbot 2.2 also introduces Script Bots, which are fully customizable and programmable bots that use the framework of Haasbot. Script Bots are perfect for developers who want to make their own custom bots to do exactly what they want them to do. Developers have access to indicators via TA-Lib, price updates, order tracking, wallet information, and placing and canceling orders. Developers can use the variables to develop bots to do whatever they would like. Script Bots are written in C# and users can simply download a script bot file and load it into Haasbot and let the Script Bot run. The options are virtually limitless.

Overall, Haasbot 2.2 introduces a lot of new concepts and tons of flexibility for cryptocurrency traders. Traders with all sorts of different backgrounds can utilize the large amount of features to automate their cryptocurrency trading strategies and the marketview page allows users to use Haasbot as a trading platform for when they want to manually trade. The goal for Haasbot 2.2 was to increase the functionality of the software and to further innovate within the cryptocurrency trading automation and trading platform space.

Related News