Alt-currency firm BizX nabs $700k

Bitcoin isn't the only alternative currency enjoying some momentum and buzz these days. BizX, an 11-year-old company that provides a trading mechanism for its BizX dollars, just scored $700,000 in Series A funding from angel investors ... its first outside investment ever. Based in Bellevue, Washington, the company is different from bitcoin in that its alternative currency doesn't involve currency exchanges. Instead, it functions as an alternative trading mechanism for roughly 2,500 firms, in a closed-loop system that is similar to a bartering network. BizX takes between 12 and 15....

Related News

PRESS RELEASE. Coinrule – a hyper-growth, automated trading platform based out of London, UK – is poised for explosive growth in the months ahead, after announcing that its recent investment round on Seedrs secured over 200% of its target, raising $700k, at a valuation of $6m. This funding will allow Coinrule to grow the team, expand into the fast-growing market of tokenised stock trading, and deliver a ‘market leading backtesting tool’, all aimed at furthering their mission of democratizing access to finance. 2020 has been an extraordinary year in crypto, with a....

eCurrency Mint (eCM), a Dublin-based company that has pioneered a new technology that enables central banks to issue digital fiat currency, has received an undisclosed amount of Series C funding from Omidyar Network, a global investment firm launched by eBay founder Pierre Omidyar. The investment helps sets the stage to establish digital fiat currency, which portends numerous benefits over physical currency for bankers, merchants and consumers. The Wall Street Journal also has an article noting that eCM has met with 30 central banks which are exploring digital currency backed by....

Ripple Labs, Inc. has been handed a US$700K civil enforcement action on behalf on the Financial Crimes Enforcement Network (FinCEN). Working in coordination with a number of law agencies in the U.S., FinCEN has assessed a civil money penalty for “willful violation of the Bank Secrecy Act by acting as a money services business without registering with FinCEN.” The crimes enforcement network claims that Ripple failed to maintain adequate anti-money laundering (AML) procedures to ensure clients were not using the service to avoid taxation and hiding the source of funds, among other things.....

According to Fortune, Wall Street Heavy Weight, Michelle Burns has joined the Board of Circle. "Burns's move is another sign that Bitcoins are starting to gain some following among established financial players. She is the former CEO of human resources consulting firm Mercer. Along with Goldman (GS), she is also on the board of Cisco Systems (CSCO) and the Elton John Aids foundation. She is also a former board member of Wal-Mart (WMT). And her Wal-Mart connection might be the most valuable to Circle, and Bitcoin in general. A growing number of retailers are considering whether to accept....

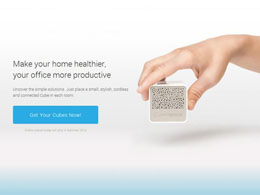

The founders of one of the largest bitcoin exchanges on the planet are getting in touch with their roots. Both Nejc Kodrič and Damijan Merlak have reportedly made a significant investment in a Slovenian hardware start-up. Together, the two raised a whopping $700,000 worth of bitcoin. That start-up is CubeSensors, and they manufacture tiny cube sensors (if you haven't already guessed) that measure environmental elements like air quality, temperature, noise, light, pressure in one's home wirelessly. Kodrič and Merlak started Bitstamp in Slovenia, but are now based out of the United Kingdom.....