BTC.sx revives bitcoin margin trades

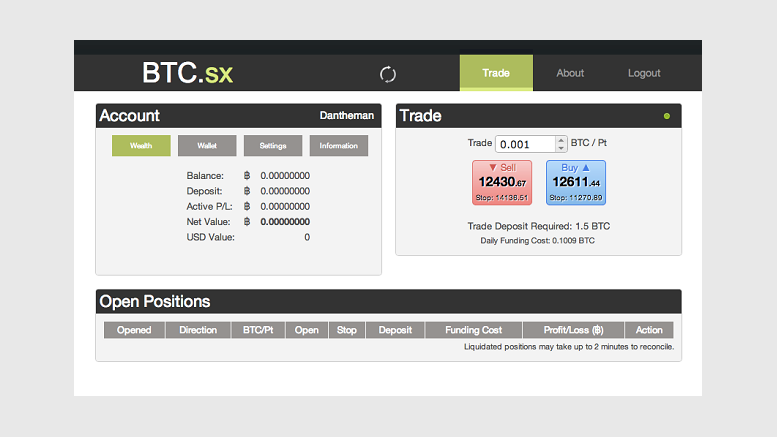

Bitcoin margin trading is back. A new trading platform, BTC.sx, is offering investors the chance to take short and long positions on future bitcoin price movements against the dollar. The platform, which is in private beta, enables a position is to be opened for varying lengths of time, from a few hours to weeks. Founder Joseph Lee, a Brit-based in Australia, works in the finance industry. He developed the trading platform himself, having used his own scripted trading bots to generate a $150,000 profit in bitcoins, he said. Like other margin trading sites, BTC.sx uses leveraged positions.....

Related News

OKCoin, a cryptocurrency exchange that offers trades between Bitcoin (BTC), Litecoin (LTC), US Dollar (USD), and Chinese Yuan (CNY), has added margin trading to its iOS and Android apps. “In our continued efforts to build the world’s best retail and institutional blockchain asset exchange, OKCoin has added margin trading to its iOS and Android Apps. OKCoin.cn CNY users can trade on up to 5x margin while OKCoin.com USD users can trade on up to 3.3x margin. Thanks for your feedback and continued support of OKCoin. We hope you like it!” added OKCoin in a statement. OKCoin released the....

EasyFi’s On-chain Permissionless Margin Trading Protocol aims to bring scale to the burgeoning DEX based trades The permissionless and composability ethos of the DeFi space has allowed the creation, listing and trading of the almost 20000 tokens and coins with varying degrees of liquidity, volumes and growth. Leveraged trading, however, has had its share of centralization with over $200 billion worth of margin trades happening on a daily basis on the many centralized exchanges. On DEXs – not so much! Permissionless markets for leveraged trading have been few and far between and that....

Matching our analysis, Bitcoin price plunged to near $500 BTC/USD today. That is if you were looking at the Bitstamp exchange price. BitFinex, on the other hand, saw $460 followed by a return to $500 only to slam down to $451 a few seconds later. Is this the result of some systemic error or perhaps manipulation being exercised via the BitFinex exchange? Could it be that some early adopters are cashing out, or perhaps the news? Far from it, as the following explanation will clarify. BitFinex is one of the few major exchanges that offers traders the option of margin-based trading. The others....

Margin Trading Was The Cause? Some theorize there are whales (people with large enough funds that they can make the market shift noticeably) who are pushing (selling lots of Bitcoins) through margin calls. Margin calls is an element of margin trading. A margin trader can deposit funds in a specified account with a related business - in this scenario, digital currency exchanges. Or specifically some have mentioned Bitfinex. Once a margin trader has deposited her or his funds they receive percent of it back as credit. For example, you deposit $5,000 in Bitcoin and you would have your account....

eToro is taking heat after calling in margin trades at the peak of Bitcoin’s record rally. A Wall Street Journal report published Jan. 12 claims European eToro users were given just four hours notice that the platform's margin trading services would be halted on Friday.EToro users were informed they must increase their margin collateral to 100% in an email sent at 4:46 UTC on Jan. 8. The platform closed the contracts of any European crypto trader who didn’t bolster their margin collateral to 100% by 9:00 PM. When the firm called in the margin trades, the users’ crypto was automatically....