Bitcoin debit card iBTCard will offer lower processing fees for merchants

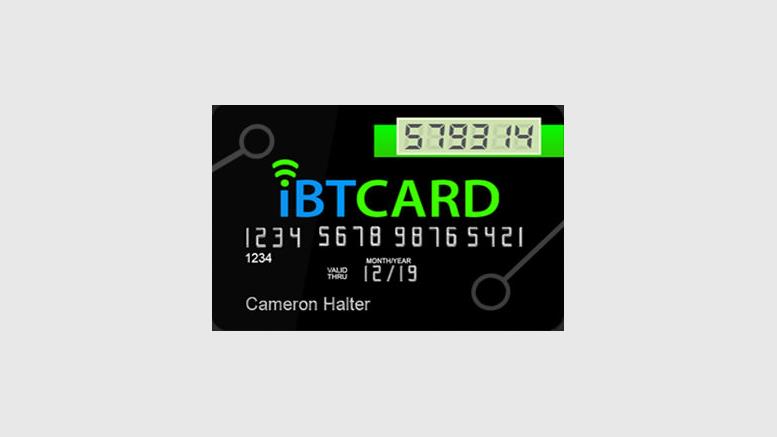

A new way to pay by bitcoin is on the horizon, a bitcoin debit card called iBTCard. That name stands for International Bitcoin Transfer Card. The company behind the project, Tradecoinz LLC, is hoping to provide an alternative payment method to VISA and MasterCard, but in a way that most people can recognise and understand. We spoke to the founder and CEO of Tradecoinz, Cameron Halter, who told us that iBTCard will register with FinCEN as a money services business (MSB). He also stated that there will be policies in place to prevent theft and money laundering. One of those methods is a....

Related News

Unreasonably high card fees continue to be borne by retailers and ultimately by consumers. Merchants are paying billions of dollars to have issuers process their debit and credit card transactions. The high transaction fees issuers charge retailers is despite the 42 percent cost reduction card issuers have achieved over the past five years. Another issue....

XAPO Cat is watching you... You may have heard about how XAPO is charging excessive previously undisclosed fees on their Xapo Debit Card, but what you may not know is that they will reimburse you for the third-party monthly fees, in Bitcoin! Though, aside from the $15 shipping fees, XAPO included a few other hidden fees they consider to be "customary fees just as with any other debit card." XAPO Debit Card Fees. XAPO has been under a lot of PR stress lately as they released the fee schedule from their debit card supplier. On August 4th, XAPO posted an update on their news feed which stated....

Morning Consult conducted a national survey of 1,999 registered voters in the U.S. from Oct. 13 -15, 2016, and came up with data that shows that more than six in ten consumers want a repeal of the merchant markup, known commonly as the Durbin Amendment of the Dodd-Frank Act. As a part of the 2010 Dodd-Frank Act, the Durbin Amendment lowered debit card interchange fees — charges that stores pay banks every time a customer swipes a debit card to make a purchase — costing consumers an estimated $4 bln annually. According to the Federal Reserve, a transaction involves five main parties: the....

It's almost essential today for merchants to accept credit or debit cards. Indeed, it is often the only form of payment in a customer's wallet. However, in exchange for accepting cards, merchants must pay for a number of services that they may not need or want as part of the blanket fees charged by payment processors. There are even some examples where merchants offer customers a discount in exchange for paying in cash, such as gas stations in the US, which often advertise a cheaper price to customers using physical money. The card companies, banks and payment processors cooperate together....

Bitcoin merchant services provider BitPay has introduced its latest product offering, a bitcoin-funded Visa debit card. The prepaid bitcoin debit card allows users to spend their bitcoin anywhere Visa is accepted. The BitPay Card is currently available to customers anywhere in the United States. BitPay’s core business lies in providing services for....