Comparing Bitcoins and Oranges

When it comes to valuation of any commodity there are two main players in the game, producers and investors. Let's take an example from the real world orange juice market. There are producers, the orange farmers, who utilize their land to create material commonly known as oranges. The primary requirements to produce oranges are land, farming equipment and labor. Add the cost of the resources together and the farmer has a base price in which he is willing to sell them. Orange juice manufacturers are buyers of the oranges to produce a good, orange juice, that we all enjoy from time to time.....

Related News

Comparing Ethereum and Litecoin is like comparing apples to oranges. They both serve different purposes. However, in few aspects, Etheruem is designed to overcome certain challenges that Litecoin eventually failed to address. In the past few months, Ethereum has climbed up the ranks to become the second largest cryptocurrency. Ethereum efficiently displaced Litecoin which has been holding that position for a very long time to take its place on the list. Litecoin is an altcoin created by Charles Lee. It was released on October 7, 2011. The cryptocurrency was developed to overcome certain....

A reading of Nic Carter’s latest essay for CoinDesk on the inappropriateness of comparing the energy consumption of bitcoin and Visa transactions.

Comparing past crypto cycles shows there is a clear pattern, and Bitcoin seems to be nowhere near the top right now. Bitcoin researcher Dor Shaher has pointed out on Twitter that there is consistency in the way correction periods have played out in previous cycles. Bitcoin Price Growth Since Cycle Low Here is a chart […]

Binance, the world’s largest crypto exchange by trading volume, posted a puzzling image on X on Monday that could hint at major upcoming developments for the Shiba Inu ecosystem. The image, which showed a Shiba Inu dog next to two oranges on a piece of luggage wrapped in Binance’s signature yellow ribbon, was captioned “pawsitively […]

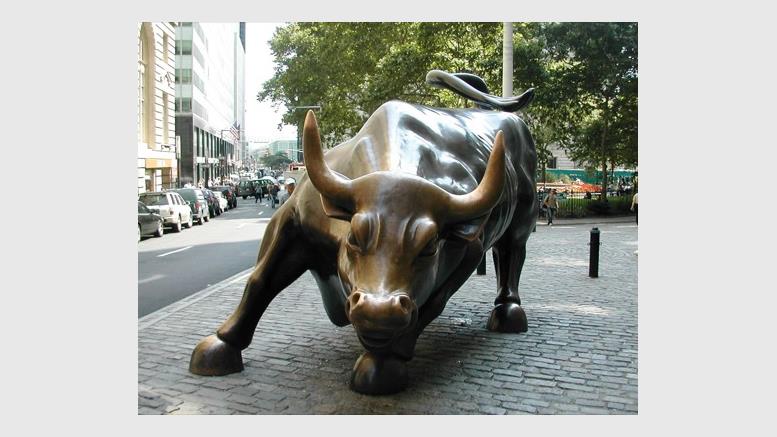

2020 has been a rough year for markets but Bitcoin has outperformed JPMorgan, Goldman Sachs, and the majority of top U.S. financial sector stocks. Historically, traditional market analysts and old school investors tend to look at Bitcoin and other cryptocurrencies with a wary eye, and when crypto pundits attempt to make comparisons between the two these investors say it's an apples to oranges argument. Take, for example, Warren Buffett, who many a time has said Bitcoin is nothing more than a Ponzi scheme as it does not produce anything and therefore has no value. According to these....