Bitcoin Price View & Trading Update: Increased Long Position

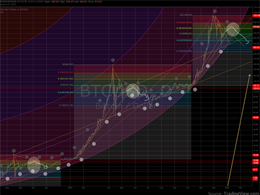

My working chart, showing Bitcoin price candles, grey volume bars, fractal highs(^) and lows(v), trendlines, support / resistance levels, Fibonacci retracement levels, MACD indicator and Moon Phases. I've discussed the use of all the indicators and line studies on my chart in previous articles, particularly this one. The only new addition this time is Moon Phases - note the two white full moons and two blue new moons in close proximity to price. Moon Phases show the extremes of the moon's waxing / waning cycle. I've included them as these lunar periods marked the last three significant....

Related News

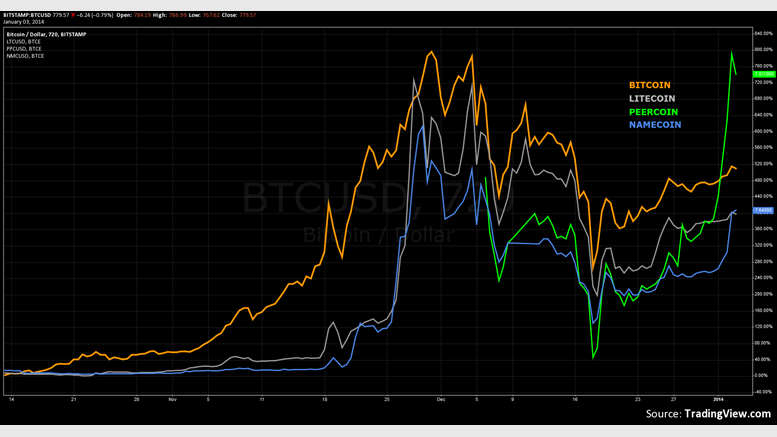

Bitcoin price has broken the key psychological level of $1000 on Mt. Gox and pushed above $900 on Bitstamp. The Bitcoin price is exploding right now! Possible reasons for the push are mentioned elsewhere on CCN. As can be seen above on the daily chart, a long green candle is forming on the 5th day of consecutive gains. This is good news for all of us with long positions. I added the final portion to my long position on Friday the 3rd as the Bitcoin price cleared the key $800 Support / Resistance level. As price has also blasted through the 76.4% Fibonacci line (dark blue), I see no obvious....

Opened 1st Bitcoin trade position, price currently misbehaving. Above is my current working chart. It shows a new Fibonacci retracement of the previous downtrend, the MACD indicator and fractal ^ symbols - these are historically significant high and low turning points. An explanation of Fib levels and the MACD can be found in Part 1 of my previous forecast. Also shown is my stoploss level, a major Support / Resistance line at $800 and the All Time High. My current trading plan, as well as previous plans, can be seen on my Trading View profile. I'd like to recommend Trading View again, they....

Data shows pro traders increased leveraged long positions even as the Bitcoin price traded in a tight range this week. Bitcoin (BTC) might have been ranging from $57,000 to $59,500 over the last couple of days, but the top traders at major exchanges have increased their long positions. A similar move also happened in the monthly futures contracts, as the basis rate has increased.Bitcoin price at Coinbase, USD. Source: TradingViewAfter marking a $61,750 all-time high on March 13, Bitcoin has been trying to find new support levels. Although BTC initially held ground at $54,000, there....

Data shows the recent crash hasn’t shaken the long-term holders of Bitcoin, as they have only increased their supply further. Bitcoin Long-Term Holder Net Position Change Has Been Positive Recently As explained by analyst Ali Martinez in a new post on X, the supply held by the BTC long-term holders has increased during the latest […]

Bitcoin price continues trading sideways as the market ponders its next move. If price action repeats the corrective price pattern circled in magenta, we may see the next wave down in the coming days. There is an annual pivot level at the level annotated in orange. Price may pause at this previous low, and even bounce higher in a more complex correction, so the xbt.social trade recommendation that will be issued later today will only be for a half size position. The position can then be increased as decline continues below this strong support zone.