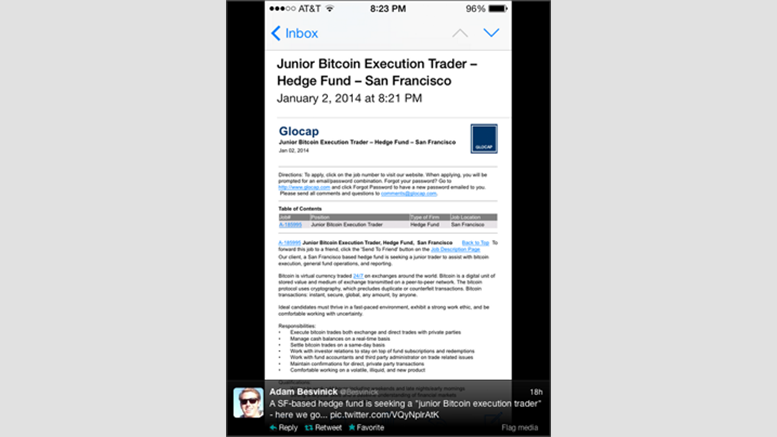

San Francisco-Based Hedge Fund Looking For Bitcoin Trader

No longer is bitcoin for the enthusiast, it would seem. With increasing popularity, businesses - and now financial institutions - are looking to get their hands into the pot. Case in point: A San Francisco-based hedge fund is seeking to bring aboard what they call a "Junior Bitcoin Execution Trader", according to a job posting by Glocap that was emailed to a list of subscribers. The hedge fund's (unclear just which one) "seeking a junior trader to assist with bitcoin execution, general fund operations, and reporting." We've seen interest in bitcoin from hedge funds before, but this is the....

Related News

…And they’re paid in Bitcoin. Yes, it does sound like a joke, but San Francisco hedge fund startup, Numerai, is attracting an increasing number of big name investors. First, Hedge Funds Need Data. Running a hedge fund requires the processing of vast amounts of data… or one guy, up to his eyeballs on coke, throwing sticky darts at a computer screen, but let’s ignore him. The majority of funds are still managed by humans: analyzing market trends, breaking (and expected) financial news, along with a wealth of other information. This data guides the human manager when making the investment....

Numerai, a hedge fund based in San Francisco, has gained a following since launching this month as the first hedge fund that gives stock market data to machine learning scientists using structure-preserving encryption. The fund allows open participation by data scientists around the world. Founder Richard Craib and his company recently completed their first round of venture funding, led by the New York venture capital firm Union Square Ventures, according to Wired. Union Square has invested $3 million in the round, with an additional $3 million coming from others. Numerai has built a....

The pseudonymous trader said in his early Wednesday tweet that he is looking to open a high reward/risk short hedge against a likely Bitcoin top.

In July, a hedge fund in Jersey issued a press release announcing that it had become the first regulated fund to deal in bitcoin. The Jersey fund, called Global Advisors Bitcoin Investment Fund (GABI), later said it was seeking $200m in assets under management. In subsequent months, mentions of GABI have been regularly prefaced by its status as the first regulated bitcoin hedge fund by everyone from the BBC to Newsweek. Now another hedge fund is challenging GABI's claim. Crypto Currency Fund, managed by Timothy Enneking, says that it, not GABI, should rightfully be referred to as the....

The British IT professional has revealed that his attempt to recover his lost fortune has been sponsored by a multi-billion dollar hedge fund that is willing to cover any and all costs associated with the hunt, including all necessary equipment. Hedge Fund To Back Hunt James Howells, a British IT professional who threw out a […]