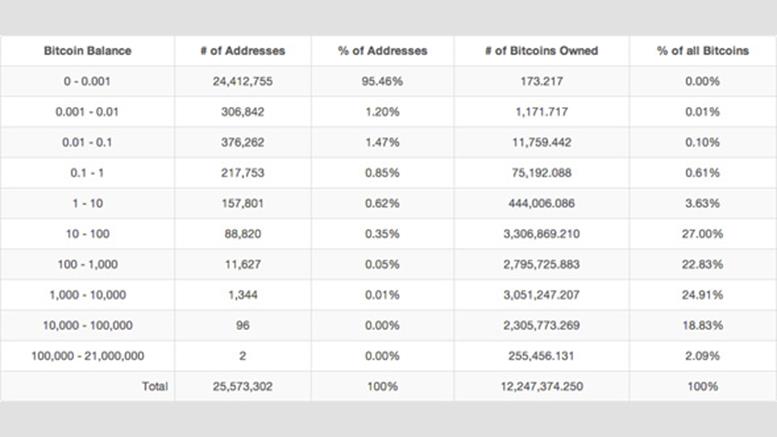

Over 95% of In-Use Bitcoin Addresses Hold 0.001 BTC Or Less

Here's a chart you may or may not find of interest (but we did, hence the post). A distribution of bitcoins by address, as compiled by BitcoinRichList.com. According to a chart, about 95.46 percent of in-use addresses hold 0.001 BTC or less (as of block 280,000). That means that if any of your bitcoin addresses hold between 0.01 and 0.1 BTC, you're in the 1 percent of the 'richest' bitcoin addresses. With higher balances come lower percentages, but it's interesting to see the distribution of the 12+ million bitcoins out in circulation at the moment. It's also important to remember that....

Related News

While bitcoin has risen in value in recent times, jumping 8% during the last seven days, statistics show that the number of addresses holding bitcoin has surpassed 40 million addresses. Metrics from the analytics web portal intotheblock.com show addresses that hold any fraction of bitcoin tapped a 30-day high on March 24, reaching 40.25 million addresses.

Addresses That Hold a Small Fraction of Bitcoin or More Swelled Past 40 Million

Non-zero bitcoin (BTC) addresses or accounts that hold at least a single satoshi of BTC has grown at a parabolic rate since 2018. The news was....

Bitcoin’s top 100 richest addresses have snapped up almost 350,000 more BTC in the last 30 days. The top 100 richest Bitcoin addresses are increasingly bullish, accumulating 16% more Bitcoin over the last 30 days. In total these addresses added 334,000 more Bitcoin to their bags, or around $11 billion worth.The majority barely reacted to Bitcoin’s recent price drop from $41,000 to below $33,000. Only seven addresses conducted a transfer out of the wallet since the most recent all-time-high on January 10.Of the addresses that have transacted in the last 30 days, only eight of them have more....

On-chain data shows the Bitcoin whales have been buying the dip, as their addresses have surged back towards pre-crash levels again. Bitcoin Whales Have Fully Recovered To Their Pre-Crash Number As pointed out by an analyst in a post on X, the whales appear to have been accumulating recently. The relevant indicator here is the “whale address count,” which measures the total number of Bitcoin addresses that hold at least 1,000 BTC and at most 10,000 BTC. At the current exchange rate, this range converts to approximately $26 million at the lower bound and $260 million at the....

With the number of “wholecoiner” Bitcoin wallets holding at least 1 BTC increasing every year, the remaining addresses represent just 5% of Bitcoin’s market cap. New data suggests that “wholecoiners” — Bitcoin wallets holding 1 BTC or more — now account for 95% of the cryptocurrency’s entire capitalization. That leaves just 5% of the market cap divided among tens of millions of users with a balance below 1BTC.The total number of wholecoiner addresses has steadily increased year-over-year since 2009, despite BTC's astronomic price rallies. On Nov. 27, Glassnode CTO Rafael Shultze-Kraft....

The number of Ethereum addresses holding at least 1,000 ETH dropped to a four-year low this week. Ethereum is having difficulty keeping its richest investors in line as its native token, Ether (ETH), hints at logging more losses in the near term.Blockchain data analytics service Glassnode revealed that the number of Ethereum addresses holding at least 1,000 ETH dropped to 6,292 this Monday, the lowest reading since April 2017. At its year-to-date peak, the numbers were 7,239 in January.Number of Ethereum addresses with balance of at least 1,000 ETH. Source: GlassnodeOn-chain analysts....