Fortress Investment Group Puts $20 Million Into Bitcoin

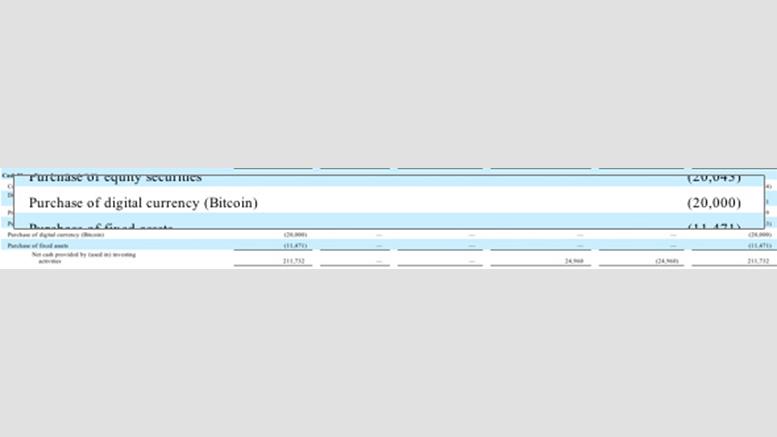

An SEC filing from last year shows that the Fortress Investment Group previously purchased $20 million worth of bitcoin. The company is reportedly preparing themselves for a launch of an Exchange Traded Fund (ETF). At the end of 2013, the group reported having on the order of $16.26 million worth of bitcoin holdings, reporting over $3.7 million in losses or unrealized gains, according to bitcoin news website CoinDesk. When you consider how much the price have dropped since the end of last year, it's very likely the company's losses are, at this juncture, even greater. All told, this makes....

Related News

Fortress Investment Group purchased $20m worth of bitcoins last year, according to a recent filing with the SEC. Back in December it was rumoured that Fortress had plans to launch a bitcoin investment fund. The news was first reported by CNN, but it could not be confirmed until now. Fortress is said to be developing a new investment vehicle based on bitcoin which is expected to be an unlisted Exchange Traded Fund (ETF). The move appears to have been connected to San Francisco-based Pantera Capital. Pantera then registered an investment advisor entity called Pantera Bitcoin Advisors LLC and....

Fortress Investment Group is the first large public company to file Bitcoin holdings with the SEC. (NYTimes) Fortress Financial Group LLC, an asset manager worth $4.25 billion, reported in its annual SEC filing a $3.7 million unrealized loss in bitcoin holdings. I wouldn't feel too bad for Fortress though, as its latest financial report includes this statement by CEO Randy Nardone: “It was an outstanding year for Fortress, driven by strong investment performance across virtually all asset classes and funds. Full year distributable earnings per share increased by nearly 70% over 2012, and....

New York City-based Fortress Investment Group, a publicly traded company, is reportedly planning to launch a bitcoin investment fund. It's being reported that the investment vehicle may be an unlisted Exchange Traded Fund (ETF). It appears that there might be some association between Fortress's effort and that of San Francisco-based Pantera Capital. Pantera, which has as clients some Fortress executives, has filed with the Securities and Exchange Commission (SEC) an investment advisor entity called Pantera Bitcoin Advisors, LLC. The filing shows Pantera Capital as the owner of the LLC,....

Fortress Investment Group LLC and Pantera Capital have announced that they are teaming up to form an investment fund focused on virtual currencies. According to the Wall Street Journal, the joint venture Pantera Bitcoin Partners LLC, is controlled by Pantera and allows minority equity partners Fortress, Benchmark Capital and Ribbit Capital to manage future and existing virtual currency-related investments through the fund. New York based Fortress, who manages about $58 billion in assets, was an early bitcoin investor. A recent regulatory filing indicates the firm purchased $20 million....

Investment firms Fortress Investment Group (FIG), Benchmark Capital and Ribbit Capital have teamed up with Pantera Capital to launch a bitcoin investment fund. The new fund will be known as Pantera Bitcoin Partners LLC and, as the name implies, it will be controlled by Pantera. Fortress, Ribbit Capital and Benchmark Capital will be minority equity partners. Fortress became the first Wall Street investment firm to enter the bitcoin space. Last year it was rumoured to be acquiring bitcoins and a regulatory filing published in February revealed it had set aside $20m for bitcoin investments in....