Central Bank of Trinidad and Tobago Issues Bitcoin Warning

Another day, another warning on the perils of getting involved with digital currency from a central bank. This time around it's the Central Bank of Trinidad and Tobago, who's issued the following warning on the use of digital currencies, as reported by the print version of the Guardian TT (found here): Potential users of this product must be aware of the risks involved in investing in virtual currencies as regulators seek to establish appropriate frameworks to ensure the continued safe operation of the payments system and the smooth conduct of monetary policy. On the topic of regulation,....

Related News

The United States is just now getting its first Bitcoin exchanges via Bitcoin merchant leader Coinbase. The Winklevoss twins' will have their "fully-compliant" Gemini project up in New York later this year. Due to onerous state and federal regulations and costs for any financial services enterprise, the U. S. has been several steps behind the rest of the world when it comes to making a Bitcoin marketplace. Now, the tiny island nation of Trinidad and Tobago is about to quickly catch-up with the Western giant in the Bitcoin economic system. Bitt looks to be the Caribbean leader in Bitcoin....

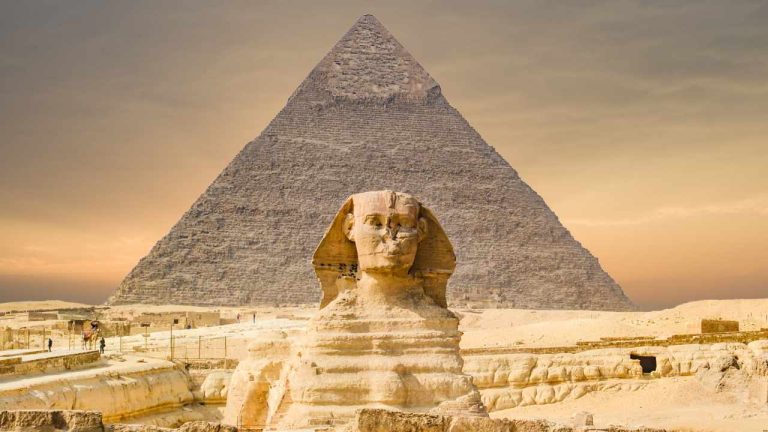

The Central Bank of Egypt (CBE) has issued a fresh warning about cryptocurrency, noting that violators could face imprisonment. The Egyptian central bank’s law “prohibits issuing, trading, or promoting cryptocurrencies, creating or operating platforms for trading it, or carrying out related activities.”

Crypto Warning Issued by Egypt’s Central Bank

The Central Bank of Egypt (CBE) has renewed its warning about all types of cryptocurrencies, citing a number of risks, including high volatility, use in financial crimes, and e-piracy, Egypt....

The Bank of Lebanon, the country's central bank, has issued a bitcoin warning, the first such warning in the region. The warning was issued on 19th December 2013 and outlines a number of risks associated with digital currencies, many of which we are all too familiar with. The Bank warns of several risks: Transactions made through unregulated networks cannot be guaranteed and losses cannot be recovered. Unauthorized and incorrect transactions using digital currencies are irreversible. The highly speculative nature of digital currencies and the fact that they are not guaranteed by any....

Barclays Bank, one of the largest banks in the world, has today issued a warning on the nascent digital currency Bitcoin arguing that it is not backed by any government or central bank and the deposits are not insured. The warning follows numerous similar warnings by Consumer Financial Protection Bureaus in the aftermath of the still mysterious downfall of MT Gox. Barclays urges its customers to beware of hackers and scammers and beware of rate fluctuations as well as general advice such as carefully read the contract and know with who you are dealing. Absent from the warning however is....

Sri Lanka’s central bank issued a warning regarding the use of cryptocurrencies amid a devastating economic and political crisis. The central bank stressed that it “has not given any license or authorization to any entity or company to operate schemes” involving cryptocurrencies. Sri Lanka’s Central Bank Issues Notice About Cryptocurrency The Central Bank of Sri Lanka (CBSL) published a notice about cryptocurrency Tuesday titled “Public Awareness in Relation to the Use of Virtual Currencies in Sri Lanka.” The notice cites “recent development....