Banks, Corruption and Crypto: Can Bitcoin Change India?

Last December, the Reserve Bank of India (RBI) issued a warning on digital currencies noting that the bank had not yet authorized any organisation in India to use cryptocurrencies as a method of payment. As a result, several bitcoin exchanges in India suspended operations, and at least two were raided by government officials, including Buysellbitcoin.in. Yet, just days later, a deputy governor of the RBI seemed reluctant to concede that it was the bank's job to regulate digital currencies. Soon after, one exchange, Unocoin, was back in operation. Additionally, around this time, Bitcoin....

Related News

Over the past few years, banks have destroyed the precarious trust relation they had established with their customer base. Ever since the latest financial crisis hit in 2008, banks have been facing a lot of scrutiny from the general population and government officials alike. The latest anti-corruption campaign in Beijing has claimed three more victims, one of whom is the president of one of China’s largest banks. Company executives and government officials have been targeted by China’s massive anti-corruption probe since 2013 when President Xi Jinping was put in charge. Over the course of....

India’s central bank, the Reserve Bank of India (RBI), has reportedly informally asked banks to cut ties with cryptocurrency exchanges and traders. Some banks in India have limited their exposure to the crypto market and some plan to stop all crypto-related transactions. RBI Asking Banks to Cut Ties With Customers Dealing With Cryptocurrencies The Indian central bank has informally urged lenders “to cut ties with cryptocurrency exchanges and traders,” Reuters reported Thursday, citing three unnamed sources. The news outlet quoted a senior bank executive as saying: The....

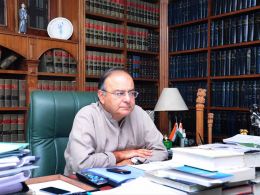

Arun Jaitley, Finance Minister of Corporate Affairs in the Cabinet of India, has said that banks should start to promote digital banking in ‘mission mode’ to limit the use of physical currency. It is hoped that by doing so cashless transactions will increase in the country, reports The Times of India. Only recently the Indian Prime Minister Narendra Modi announced the banning of two of the country’s biggest fiat banknotes in the country. The move, according to Modi, was to tackle corruption, black money, and terrorism. It is also believed that the withdrawal of the Rs 500 and Rs 1,000....

Working around the cash shortage in India has become a puzzle. Banks are experimenting with ATM buses, and it is possible to hire people who will stand in line for you. Obtaining new rupee banknotes in India remains a big struggle to his very day. Nearly a month after the cash ban had gone into effect, a lot of residents are still waiting in line outside bank branches. Thanks to Snapdeal, it is now possible to purchase new bills online and have them delivered to a home address. Orders can be placed with debit cards, and there is one rupee commission. Things have gotten out of hand rather....

India is now the second biggest user of Purse.io’s ‘Bitcoin Amazon’ as sweeping changes take effect over the country’s currency, the rupee. Cash Removals ‘Strengthening the Common Man’. In a televised speech, Prime inister Narendra Modi declared this week that larger-denomination rupee bills, specifically 500 ($7.50) and 1000 ($15) rupees, would no....