PBOC Orders All Chinese Banks And Third Party Payment Processors To Close Accounts Of Chinese Bitcoin Exchanges by 4/15

Original Chinese article here. English article by Caixin. Caixin is a trusted Chinese financial news source. Ties to the 3/21/14 Sina.com FUD incident. In contrast to the 3/21/14 incident mentioned by OKCoin, this news was broken by Caixin not Sina. More importantly, the original article has not yet been rescinded. In the original rescinded Sina article that turned out not to be true, it was claimed that on 3/18/14 a document was released that would have banned Bitcoin transactions in China by 4/15/14. The PBOC took to Weibo to announce that: "Regarding the PBOC statement issued on 3/18....

Related News

Yesterday, Caixin reported that the PBOC, led by the Payment and Clearing Organization of China, has been having meetings and interviews with commercial banks, third party payment processors, and Bitcoin exchanges within China. PBOC officials made it very clear that they wished to completely cut off the funding line of Chinese RMB into Bitcoin trading platforms around the country. The renewed interest in Bitcoin by the PBOC has led to funding shuffles from every Chinese Bitcoin exchange. Cryptocurrency exchange rates across the board have suffered since the first rumors of renewed the....

Caixin is a respected Chinese financial news source. Bitcoin prices have dropped nearly 10% across all Bitcoin exchanges, with the bulk of the action understandably located on Chinese Bitcoin Exchanges. A few hours ago, Caixin published a Chinese article claiming that the PBOC has met with commercial banks and third party payment processors, in particular those that do, or have done, business with Chinese Bitcoin Exchanges to remind them of the PBOC's stance. This Caixin article is written by a different author than the last Caixin article that was commented on in Western media (which....

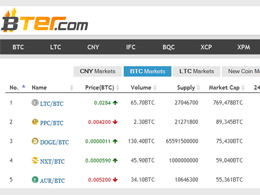

At 12:06 local time, Bter, one of China's larger Bitcoin exchanges, posted an announcement to its website announcing a temporary suspension of deposits. What's more is Bter cites official regulation that they were just informed of, as the ultimate reason for this incredible convenience to its users. Bter not only offered RMB to BTC markets but also RMB to LTC, Dogecoin, Auroracoin, and even Counterparty (XCP). Many Bitcoiners on both sides of the Pacific are wondering if other Chinese Bitcoin exchanges will soon follow suit and suspend CNY deposits. In the meantime, CNY withdrawals, as....

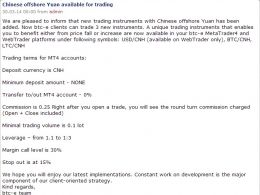

BTC-e has opened up USD/CNH, BTC/CNH, and LTC/CNH markets today. Withlooming PBOC action that would end Chinese Bitcoin exchange's access to domestic bank accounts, Chinese traders are undoubtedly looking for new exchanges to trade on. Along with Chinese RMB (CNH to BTC-e) trading comes RMB deposits, which are handled through an international bank. An international bank means that Chinese traders wishing to convert fiat to crypto through this route will be subject to the Chinese $50,000 annual limit. In fact, people are starting to realize that the PBOC's still shrouded notice to regional....

There's a lot that's unclear in China right now. Yesterday, we learned that several exchanges in the country have stopped some services. Popular Chinese Bitcoin Exchange Huobi announced on its website that despite vicious rumors circulating that the People's Bank of China will be forcing banks and third-party payment processors to sever ties with bitcoin exchanges, they haven't heard any such news from the processors they work with. One of the processors (which has remained unnamed), however, did contact Huobi to discuss what CoinDesk says is "the potential risk of continuing [a]....