Bitcoin Price Defies Expectations

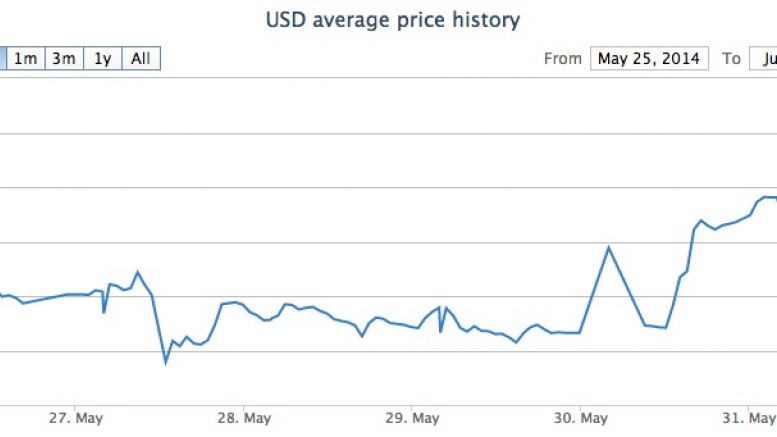

Four days ago, I wrote an article describing how Bitcoin nearly hit the $600 mark during its surge, stopping at $585. The price increase slowed for a day or two, and Bitcoin’s value remained steady. Over the past 48 hours, however, Bitcoin’s price has risen dramatically, from $570 to $640, a 12.3% increase. After the initial surge four days ago, CCN writer Venzen Khaosan predicted that the “price will reverse from current levels around $600 and may retrace at least 50% of the advance to $520″, and that “traders and investors should brace themselves for a strong price reversal.” That....

Related News

Bitcoin has been moving lower ahead of the Halving event, going against analysts’ expectations. This price action has been unexpected and shows how the coin tends to go against predictions, basically charting its path. Bitcoin Breaking The Mold In light of Bitcoin’s randomness, especially in the past few months following the approval of spot exchange-traded funds (ETFs), one analyst expects the coin to continue defying expectations by clocking in a bull run that defies historical trends. The analyst cites two recent instances where Bitcoin defied expectations to justify this....

Bitcoin price is slowly recovering from the $10,387 low against the US Dollar. BTC broke the $10,650 resistance and it might soon test the $10,800 resistance or the $10,900 barrier. Bitcoin started a fresh upward move above the $10,550 and $10,650 resistance levels. The price is up 2%, and it is trading above the $10,700 […]

The price of Bitcoin is gradually retaining its upward trend as the flagship asset eyes the $100,000 pivotal mark after a slight rebound on Monday. During the waning price performances over the past few days, recent data shows that BTC’s funding rates have persistently maintained a bullish sentiment. BTC’s Funding Rates Defies Market Dip Bitcoin […]

American inflation expectations have surged according to the results of the latest New York Federal Reserve Survey of Consumer Expectations. The presumed inflation rate tapped the highest point since 2013 and alongside the forecast of lower purchasing power, consumer debt and fears of a housing bubble in the U.S. are on the rise. New York Fed’s Consumer Expectations Report Expects Inflation to Be 4.8% Over the Next Year U.S. citizens are worried about inflation after the government locked down the nation for more than a year and the Federal Reserve increased the M1 supply by 30%.....

In a long-awaited decision, Judge Torres ruled in favor of XRP in their case against the U.S. Securities and Exchange Commission (SEC) yesterday. The verdict is a positive development for the cryptocurrency industry, particularly with a focus on whether digital assets should be deemed securities in the US. The ruling is expected to set a precedent for the industry moving forward. It is positive for both altcoins and the wider industry, as the default expectation is that these assets are not deemed securities so long as they are made available to the public. This event will likely have....