Former FinCEN Assistant Director to Address Virtual Currency Community at VC3

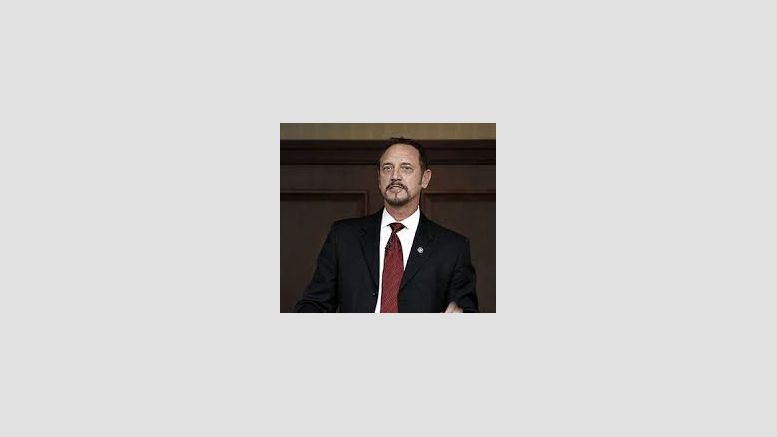

A former staffer of the United States Treasury's Financial Crimes Enforcement Network (FinCEN) will address the virtual currency community at the New York City Bar Association in Manhattan on Wednesday, August 13th. Thomas Fleming will be making an address at the Virtual Currencies Compliance Conference (also known as VC3) - an event hosted by the National Money Transmitters Association. Fleming is recognized as an expert on anti-money laundering and the Bank Secrecy Act, and previously worked as a banker for 22 years before taking a job with the federal government as an Assistant Director....

Related News

FinCEN has released two new Virtual Currency Guidance notes today. FIN-2014-R011 and FIN-2014-R2012 both detail FinCEN's response to requests "for Administrative Ruling on the Application of FinCEN's Regulations to Virtual Currency" Trading Platforms and Payment Systems. FinCEN has clarified that both would require a money transmitter license under their federal rules. FinCEN's clarifications, presented by Jamal El-Hindi, the Associate Director of FinCEN's Policy Division, may be the precursor to a new wave of Bitcoin company crackdowns. Recently, the SEC revealed that there were ongoing....

CoinDesk: How does FinCEN research the bitcoin industry and keep track of developments with the technology? FinCEN Director Jennifer Shasky Calvery: So, let me start historically, we can go even a little wider with virtual currency. I think we first really started thinking about virtual currency quite a while ago, and it was in response to working with our law enforcement partners and it was back in the days of E-gold and when virtual currencies were backed by a commodity. So, we came out with our first guidance on virtual currency in September in 2008, and again, it was based mostly on....

The Financial Crimes Enforcement Network (FinCEN) has been to date one of the most active - and more controversial - US federal agencies to address the bitcoin ecosystem, doing so through a number of published rulings aiming to provide clarity to the industry. Founded in 1990, the US agency is responsible for collecting information about financial transactions that may be used to support money laundering, terrorist financing and financial crimes. FinCEN first addressed emerging virtual currencies in 2008 and has been simultaneously praised for engaging with the bitcoin ecosystem, while....

The US Financial Crimes Enforcement Network (FinCEN) has reportedly been working with the Internal Revenue Service (IRS) to develop bitcoin training programs for tax examiners. During a speech given today at the ABA/ABA Money Laundering Enforcement Conference in Washington, DC, FinCEN director Jennifer Shasky Calvery said that the agency, one of several in the US with jurisdiction over elements of the bitcoin ecosystem, recently collaborated with the IRS to educate its examiners on relevant aspects of the technology. She remarked: "IRS has an extensive training program for its examiners,....

FinCen has issued two basic administrative rulings over digital currencies. The first one relates to the application of FinCEN regulations to a virtual currency trading platform, while the second discusses the application of FinCEN regulations to a virtual currency payment system. In ruling FIN-2014-R011, FinCen states that any and all digital currency exchanges must become licensed as a money transmitter including: On the exchange you are buying/selling bitcoins. The exchange carries the burden of giving you legal tender or a different cryptocurrency. According to the FinCen, regulations....