Coinapult Launches LOCKS, Aiming to Eliminate Bitcoin Price Volatility

Bitcoin's price volatility has long been viewed as one of the biggest barriers to mainstream consumer adoption, but while a long-recognized problem, the issue has yet to be addressed by any specific market solutions. That could be set to change, however, with the introduction of a new service from Panama-based bitcoin wallet provider Coinapult. Called LOCKS, the offering allows users outside the US to peg the value of their BTC to the price of gold, silver, British pounds, US dollars and euros. Coinapult CEO Ira Miller told CoinDesk that despite suggestions that consumers in the developed....

Related News

Price swings are a major hindrance on the average bitcoin user. It's easy to fall asleep at night thinking the price will remain steady, only to wake up and realize that your bitcoins dropped $20 in value overnight. It's one of the major reasons people decide to stay away from day trading bitcoins. The market it unpredictable on a level many traders have never seen before due to the unregulated ecosystem. Also read: Mycelium Local Trader App Is Out Of Beta: The Most Decentralized Exchange You Can Use Today. Panama-based company Coinapult created a service called Locks to combat constant....

Coinapult's new service, Locks, frees your bitcoins from price volatility by linking them to tangible assets, such as gold. Customers who lock $1,000 worth of bitcoins today will be able to cash out $1,000 worth of bitcoins today, tomorrow, next year, whenever they like - regardless of the price of bitcoin. Coinapult is FirstMark's only Bitcoin company so far, having already backed Pinterest, Luminosity, Shopify and Riot Games. Funds raised came from two separate rounds. In addition to FirstMark, Roger Ver, Erik Voorhees and Barry Silbert's Bitcoin Opportunity Corporation contributed to a....

One of the biggest concerns merchants have with Bitcoin is its volatility. They are afraid if they accept and don’t immediately exchange to fiat, the Bitcoin they do have could become worthless. What most merchants fail to see is that volatility can go both ways, but I digress. Today I’m here with Locks, a service from Coinapult that allows you to “lock” your Bitcoin to an asset, so your $1000 worth of Bitcoin stays that way. I feel this is the next step of getting merchants to actually hold Bitcoin. Most companies that accept Bitcoin instantly convert to fiat,

Coinapult, one of the biggest companies in the Bitcoin industry. When we last talked to them it was regarding the public beta launch of Locks, the ability to “lock” in your value of Bitcoin and tie it to the value of a commodity. Today, we will be talking about the funding they just received. Our Locks launch went very well. We have been developing upgrades to the website based on the initial feedback, and have already rolled out a number of improvements in our invoicing, Locks, and account interfaces. Sure, we raised a total of $775K in two seed rounds. Both rounds involved FirstMark....

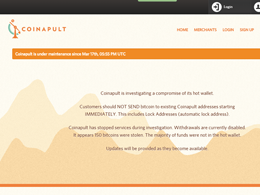

Coinapult announced that they have had their hot bitcoin wallet compromised. The amount of BTC they said is 150 coins. The hack comes on the heels of their deal with Factom. Bitcoinist covered the news on their deal. From the article about their working with Factom. Coinapult CEO, Ira Miller, had the following to say: Coinapult melds trustless, blockchain-based tokens like Bitcoin with familiar assets like US dollars. These are notoriously different and incompatible. Factom allows us to bridge the gap by digitally tagging and verifying centralized assets. Factom lets Locks act more like a....