BitLicense Bitcoins Will Trade at The Market Rate

Jason Tyra is a Certified Public Accountant and ACFE Certified Fraud Examiner. In this article, he evaluates the importance of New York's BitLicense and the effect it could have on trading in licensed exchanges. This week CoinDesk carried a piece by John Matonis, the executive director of the Bitcoin Foundation and a self-described cryptoeconomist, in which he suggested that "government tainted" bitcoins traded on licensed exchanges will trade at a discount, creating arbitrage gain opportunities for savvy traders. Matonis' argument goes like this: consumers value privacy, which is why they....

Related News

The world's largest peer-to-peer bitcoin marketplace Local Bitcoins and bitcoin marketplace BitQuick have terminated their services in New York due to the strict restrictions and fees demanded by New York's BitLicense. Local Bitcoins is a unique case; as every single seller on Local Bitcoins would be required to pay $5,000 to apply for BitLicense. The Local Bitcoins team wrote on their blog:"From today onwards users from New York are no longer allowed to use LocalBitcoins because of the legislation known as the BitLicense (23 NYCRR 200) which makes it a federal offense to sell virtual....

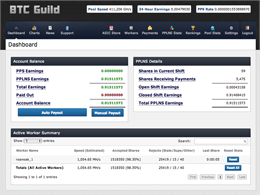

After an aborted closure of BTCGuild, when BitLicense was first announced, the company’s owner has now decided to close it for good on June 30, 2015. With NYDFS using BitLicense to try and regulate businesses inside and outside of NY, the closure comes as no surprise; the owner has stated before he will not put miners and himself through the invasive and vague regulatory hassles. Even after the release of the final BitLicense draft — revised based on a round of public comments — BTCGuild’s owner feels that there is still enough “gray area” the NYDFS can use to intervene in the company’s....

With New York's BitLicense scheme officially three months away, sophisticated traders are already devising strategies to profit from the potential arbitrage opportunities. If implemented in the regulation's final version, the physical address and identification requirements (Sections 200.12 and 200.15) for both sides of a transaction will dilute the inherent privacy of the overall bitcoin network. Due to potential IP address blocking and other techniques to identify and block New York-based traders, the exchanges operating within the jurisdiction may end up 'ring-fencing' themselves and....

BitLicense has been a huge pain to many bitcoin and digital currency based startups operating in the State of New York. Once BitLicense was made mandatory and the deadline to apply for BitLicense surpassed, few of the companies decided to withdraw their services from New York while other companies who considered New York to be an important market decided to stick on and apply for it. Circle, a bitcoin based money transfer application was one among the many bitcoin companies that applied for BitLicense and recently it went on to become the first company to receive BitLicense from New York....

The new BitLicense will open for a 30-day public comment period in just a few days. In a speech to the Bipartisan Policy Council, a Washington D. C. think tank, New York Department of Financial Services (NYDFS) Superintendent Ben Lawsky told the world about the new BitLicense's impending release date as well as several planned changes. Also read: NYDFS's Ben Lawsky Reveals Plan for Transitional BitLicense at #Money2020. Changes in the new BitLicense. Notably, a new BitLicense is not required for consumers or merchants seeking to transact in Bitcoin; furthermore, Bitcoin-related software....