China's 'Big Three' Bitcoin Exchanges: BitLicense Would Harm Overseas Markets

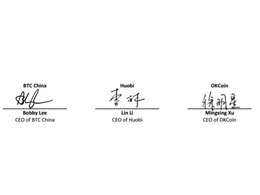

China's 'Big Three' bitcoin exchanges, OKCoin, BTC China and Huobi, have joined forces to submit feedback to Benjamin Lawsky, superintendent of the New York State Department of Financial Services (NYDFS), regarding his agency's recent BitLicense proposal. In a newly published open letter, the three companies criticized the broad reach of the regulations, stating they should only apply to businesses with meaningful connections to New York. Signed by company CEOs Bobby Lee of BTC China, Lin 'Leon' Li of Huobi and Mingxing 'Star' Xu of OKCoin, the letter said: "While we are companies....

Related News

In a true show that bitcoin is global, China's "Big Three" bitcoin exchanges have come together in order to release joint comments on the recently-released BitLicense proposal from the New York Department of Financial Services (NYDFS). Those exchanges, BTC China, Huobi, and OKCoin say that their are some fundamental issues with the proposals - which are currently in the midst of a 45-day commenting period. They write: We express our great appreciation for the historic move by you and the NYDFS to propose a tailored regulatory framework for the virtual currency industry. While we are....

Regarding the issue of the global influence that the current BitLicense proposal would have on Bitcoin-related businesses throughout the world, Lawsky said to be welcoming"as many points of views as possible" in order "to make the best decisions possible." China's "Big Three" Bitcoin exchanges BTC China, Huobi and OKCoin, transmitted their joint-comments regarding the BitLicense proposal, a series of rules which were designed to regulate virtual currency-related businesses, submitted in late-July by the New York State Department of Financial Services. "Licensee's affiliates should have no....

A new web-based app from BTC China called 'Picasso ATM' allows anyone with a smartphone to become a 'walking bitcoin ATM', without the need to invest thousands of dollars in hardware. Sellers can use the app to upload and sell bitcoins nearly anywhere in the world, in a range of major currencies. It could be the first of many moves by Chinese bitcoin exchanges to appeal to international customers. BTC China is the most prominent of China's bitcoin exchanges overseas already thanks to its English language interface and its CEO Bobby Lee's appearances at major conferences like CoinSummit.....

BitLicense, introduced in the New York state did more harm than good to the digital currency technology industry. Other governments intend to avoid making the same mistakes. Read more... When BitLicense was introduced, it was hailed as a defining moment, where the government-less and regulation-less cryptocurrency platforms meet regulatory machinery set up by governments and centralized organizations. A bit over one year down the line, BitLicense is being constantly referred back to, in order to avoid doing the same mistakes. BitLicense, introduced by Benjamin Lawsky, then Superintendent....

When the New York Department of Financial Services (NYDFS) released the final draft of BitLicense, the community worried about Bitcoin companies having trouble complying with the law. Digital currency administrators, exchanges, and traders have 45 days to apply for BitLicense; however, many of them might not be able to meet the requirements of BitLicense. In such situations, IdentityMind Global™ may help companies by providing a BitLicense compliance management platform. As the latest anti- money laundering requirements put forward by the New York Department of Financial Services (NYDFS)....