Bitcoin Fall Caused By A Single Sell Order?

On Friday afternoon, Bitcoin was selling at well over $350, and after a rough weekend where Bitcoin fell well under $300, BTC has almost completely rebounded to it's previous level. It's what happened over the weekend that has remained a mystery, until now. According to Alex Wilhelm of TechCrunch.com, a massive singular sell order for 30,000 Bitcoins was placed this past weekend at a price of just $300. This wasmore than 10% below the market price at close of business Friday, and it helped created quite the crater in the BTC market. The Bitcoin fall reached a 2014-low of $275. BTC started....

Related News

Popular bitcoin exchange Bitstamp today announced the addition of a new feature that is designed to "improve your trading experience". The company says that when traders place a limit order, they are now able to set a consecutive buying/selling order at a desired price after the first order is filled. Bitstamp says the features only available for limit orders. Traders can use it by clicking on 'Advanced', and filling in the 'Buy/Sell If Executed Price' field. Bitstamp provides the following example: - You can place a buy limit order for 1 BTC at a price of $500. - Corresponding with that....

On October 21st, 2021, crypto exchange Binance US experienced a Bitcoin flash crash to led BTC’s price to dropped by over 80%. The industry is maturing, but these occurrences reminiscent the times when a crypto flash was business as usual. Related Reading | Brace For Impact: Wall Street Is Headed Straight For Bitcoin, Says Analyst A report by Arcane Research deep dives into the event, starting from the time it happened on the aforementioned date at 11:34:17. At this time, as the research firm claims, a “sudden massive selling pressure cleared the order book” on the exchange. This....

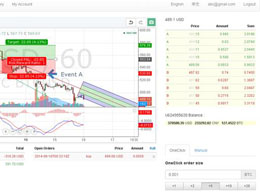

China-based cryptocurrency exchange LakeBTC has launched a new HTML5 trading tool dubbed LakeTrader. LakeTrader is an in-browser (and hence cross-platform) app that allows traders to view order book data, trade history and open orders, along with a number of powerful charting tools that allow both technical analysis and one-click trading. Streamlined orders. LakeTrader uses an HTML5 charting library and is fully integrated with the exchange's real-time API, allowing traders to place buy and sell orders with a single click, using the 'OneClick' trade mode. To use this function, the trader....

The Bitcoin price (BTC/USD) today fell below $200 on multiple exchanges, bringing the January's low within close grips. The new fall, as speculated by many online reports and discussions, was caused by the unexpected halt in BitFinex's order books. The Hong Kong digital currency exchange, which experienced a flash crash just last week, had paused its trading services for over seven hours. The decision ultimately rippled a panic sell throughout the Bitcoin market, which resulted in a 5-7% fallout in BTC/USD pair. Nevertheless, the Bitcoin market was already surrounded with a-too-many....

Librexcoin has been one of the most traded altcoins today, and it's not because its surging upwards. It has declined with more than 35% losing almost 200 000 USD in market capitalization in a couple of hours. We have earlier written about Librexcoin, which is a cryptocurrency based on the X11 algorithm (pros & cons here) that will have around 10 million coins in circulation from PoW mining, and then 2% yearly stake interest. Why has Librexcoin Lost Value? As you can see from the graph below, taken from Bittrex, there has been two big sell orders that made the price drop almost 40%. The....