"BitDollar": The United States and the Digital Future of Money

Bitcoin is not going away, and if anything it is growing into the mainstream at a consistent pace. Many American corporations, some of the largest corporations in the world, have spent 2014 endorsing Bitcoin, in spite of the drop in value. 2014 has seen nothing but price declines, but greater market acceptance in exchange. And it has even gotten the attention of the world's largest and most influential government, the United States, to respond to it in earnest. Taxation, regulation, and condemnation have all had their moment in the sun from America's governance. The U. S. seems both....

Related News

Despite some ups and downs, bitcoin has shown a refusal give up. It has earned backing by some of the largest corporations in the world, and its popularity seems to grow with time. The U. S. government has shown both interest and intimidation when it comes to the digital currency. It has seized it, sold it and taxed it, and now an economics professor at Georgetown University, James Angel, is suggesting that the government side with it. In other words, they should create what he's calling the "bitdollar," a digital currency similar to bitcoin that's also backed by the U. S. dollar. Angel....

Many of you have heard of John Mauldin. His newsletter has over 1 million readers worldwide. Several of his investment books have reached the New York Times best-seller list over the last decade. He is a constant guest financial commentator on TV and radio throughout the United States and is a renowned public speaker on finance. He is also the Chairman of Mauldin Economics, an economics publishing firm, and the President of Millennium Wave Advisors, LLC, an investment advisory firm. So he knows a thing or two about investment advice and handling finances. Now, he has come out with some....

Donald Trump's idea to finance the US-Mexico wall by imposing taxes on remittance between both countries will see people opting for Bitcoin and other cryptocurrencies. Cryptocurrencies may soon rule the United States – Mexico remittance market. As President Donald Trump reiterates his vision to build a wall between the two countries, United States may look for ways to recover a portion of expenses from Mexico either through increased taxes or remittance blockades. Mexico may not willingly bear its fair share of costs as it is not comfortable with the wall separating both countries. It....

It says users in the United States can expect digital asset services to come in the future. A subsidiary of the Huobi cryptocurrency exchange called HBIT Inc has received its Money Services Business (MSB) license from the United States Financial Crimes Enforcement Network (FinCEN).The Seychelles based Huobi said on July 5 that the license creates a foundation for it to carry out crypto-related business in the U.S. in the future, as part of its strategic goals of “globalization and compliance”. The exchange is a major player, with more than $1 billion in volume in the past 24 hours....

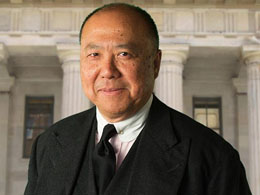

Edmund Moy, the former director of the United States Mint under the Bush administration, first learned about bitcoin in the form of a footnote embedded in a coin demand forecast report. When he became director of the Mint in 2006, Moy commissioned annual reports that detailed the various market forces and characteristics that have an impact on coinage needs in the United States. These includes the role of digital payment systems such as credit cards and emerging means of moving money around the internet. In 2009, the report included a footnote briefly describing Satoshi Nakamoto's original....