HyprKey Heightens Security for Bitcoin Users

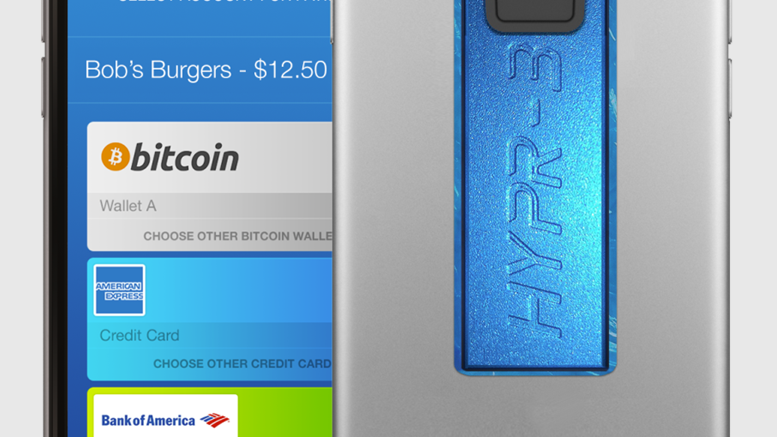

New York-based digital wallet security company HyprKey is claiming that it can make the process of paying with one's phone much safer through the usage of its new tool the HYPR-3. As a three-step biometric authentication device, the HYPR-3 is supposedly able to eliminate any likelihood of payment fraud at the point of sale for all users paying with bitcoin, credit cards and third-party digital wallets on their mobile devices. Furthermore, processing fees for payment merchants would also be significantly lowered. Company CEO George Avetisov explained the tool's workability in further....

Related News

Two-factor authentication is an industry standard pushed widely by the Bitcoin community over the past few years. Most users are pressured to secure their funds and accounts to the maximum degree as it's their money and their responsibility. Hyprkey is stepping up the industry standard with their biometric tokens based on three-factor authentication. At only the size of a nicotine patch, the HYPR-3 sticker reportedly secures and authorizes everything with a fingerprint. In a recent press release, CEO of Hypr Corp George Avetisov laid out a vision for the future of the extra level in....

If there's one thing standing in the way of mainstream bitcoin adoption, it's cyberfraud. So says the team at HyprKey, the startup aiming to protect digital currency users from fraud by utilizing the HYPR-3 three-factor authentication protocol. HyprKey works by creating a biometric authentication bridge between the user and the mobile wallet built on top of it. It auto-converts bitcoin in real-time so users can spend it without ever even touching the digital currency by linking their debit cards, thereby authenticating transactions at the point of sale. "The reason that [cyberfraud] struck....

A company based out of New York City called HyprKey aims to accomplish a three-factor level of security that credit cards, Apple Pay, CurrentC and Bitcoin haven’t. The day of paying for goods and services with our mobile devices instead of swiping credit cards is dawning. Apple Pay links customers’ credit cards to their mobile payment system, their ads seem to be everywhere, and their presence is increasing in stores. “Other attempts at tokenization of virtual credit cards have raised processing fees for merchants and wallet platforms. HYPR-3 seeks to lower them by reducing fraud. By....

As attention on inflation heightens, public companies look to a solid store of value to protect their profits.

The U.S. Department of the Treasury is seeking public input on “digital-asset-related illicit finance and national security risks.” The department warned: “The growing use of digital assets in financial activity heightens risks of crimes such as money laundering, terrorist and proliferation financing, fraud and theft schemes, and corruption.”

US Treasury Wants Public Comments on Crypto-Related Illicit Finance

The U.S. Department of the Treasury published a notice Tuesday inviting “interested members of the public to provide input pursuant to....