Automated Bitcoin Trading: Tradewave Launches Bot Maker for Non-Coders

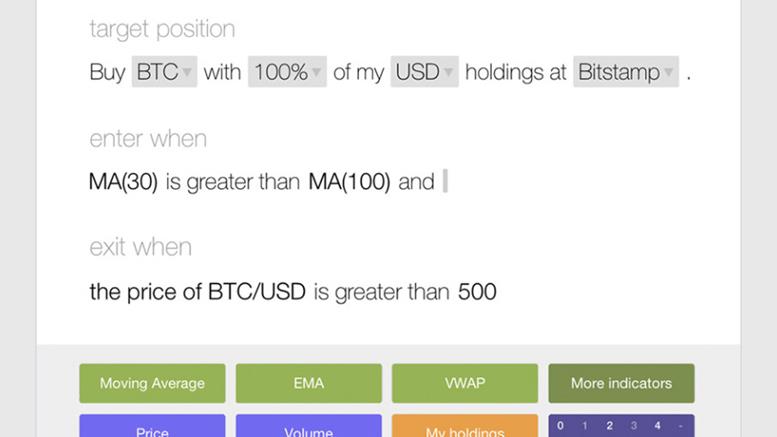

A company called Tradewave, which provides a hosted platform for cryptocurrency trading bots, has announced the launch of the first ever natural language trading strategy editor. In simple language, that means anyone can now make their own trading bots without needing to be able to write code for it. In a blog post published on 29th January, Tradewave founder James Potter describes how his firm's new system could help to level the playing field between financial institutions and regular traders: "There's an ever-growing tools gap between retail and institutional traders. It's estimated....

Related News

Algorithmic cryptocurrency trading platform Tradewave has launched a new tool which will enable users to create their own bitcoin trading bots without using code. Previously users could only use programming language Python to execute trading strategies. However, the new product opens up the automated platform to bitcoin trading newcomers or those without programming ability. James Potter, the platform's founder, said: "We looked at our collected experience over the past year, with our users coding thousands of Python-based strategies through the platform. It turns out that you can distil....

Bitcoin trading bots will no longer be the exclusive preserve of software and finance wonks if startup Tradewave has its way. The London-based company has developed a platform that lets users create their own trading bots, stripping away some of the complexities of programming such tools independently. Tradewave's founder James Potter said his platform would address the "mismatch" between institutional traders with the resources to develop their own bots and retail investors who are left to execute trades by hand: "A lot of institutional trading is now automated and retail is very manual....

Solanax, the Automated Market Maker or AMM based on Solana blockchain, is making a difference in the decentralized finance or DeFi space due to its faster blockchain speed, better and simple interface, and low gas price. As a result, it continues to drive investors to its private sales. Automated market makers (AMMs) have come a […]

The automated protocol will launch with new features allowing bitcoiners to create their own liquidity pools, fees, and perform trustless swaps.

A recent report by Consensys says the surge in decentralized exchange (DEX) volumes in Q3 of 2020 is down to their adoption of the automated market maker (AMM). According to the report, DEXs that use AMM, a software that algorithmically creates token trading pairs, now represent 93% of the market. The good side of AMMs Already, as a consequence of using the AMM, Uniswap’s September traded volume topped $15.4 billion, a figure nearly $2 billion ahead than that of Coinbase’s. Prior to the surge in the use of AMMs, order-books were used instead. The Consensys Defi report asserts....