Bitcoin or Gold - Who Will Succeed the Dollar?

We all know that the US dollar has been the global reserve for a while now, but not for long. The current economic situation looks bad for the dollar, all thanks to one-sided monopolistic and hypocritical foreign and economic policies. Thanks to the growing influence of China and Russia on the as they build their gold reserves and encourage foreign trade with domestic currencies. Chinese Yuan is a strong contender to replace the dying dollar. Russian Ruble staying right behind. United States brought this upon itself by playing hardball with the countries that refused to play along with it.....

Related News

Across multiple economic downturns and bear markets, gold has proven to be a haven for investors worldwide, with many traders and investors opting to invest in it to protect their capital against value depreciation, which occurs from inflation, causing an increase in general prices. Because gold prices are related to the US dollar value due to gold being dollar-denominated, a stronger USD keeps the price of gold down and more controlled. A weaker USD drives the gold price higher due to increasing demand. Ultimately this means that more gold can be purchased when the dollar is more....

Analysts warn that a recovery in gold and the U.S. dollar index could negatively impact Bitcoin’s bullish momentum. Dan Tapiero, the co-founder of 10T Holdings, said weak hands have been shaken out in the gold market. This raises the probability of a gold rally in the near term, especially as it comes off of an 80-day pullback period.A rally in gold and the dollar may dampen Bitcoin priceBitcoin has seen strong momentum in the past three months, as it achieved an all-time high on Coinbase and a number of other major exchanges.Despite this, the threat of a correction for Bitcoin is a real....

Precious metal markets have shuddered during the last few weeks, as gold’s price per ounce nears a six-week low hovering just under $1,700 per unit. Silver crashed through the $18 range slipping to $17.80 per ounce. While both gold and silver dipped between 0.85% to 0.89% against the U.S. dollar in 24 hours, platinum dropped 2.82% and palladium shed 4.18% against the USD during the last day.

Despite Scorching Global Inflation, Gold Hasn’t Been a Safe Haven in 2022

While the entire world is suffering from red-hot inflation, many would assume that the world’s....

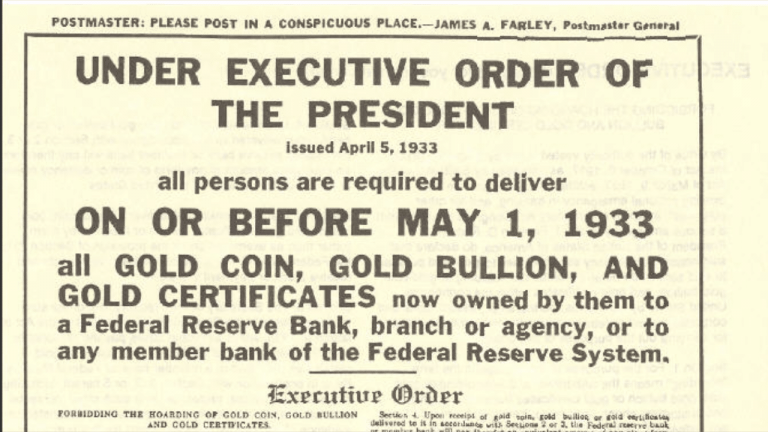

This past Tuesday, April 5, was the 89th anniversary of Executive Order 6102 when the U.S. government would strictly “forbid the hoarding of gold coin, gold bullion, and gold certificates within the continental United States.” While the global economy seems to be heading toward disaster and the U.S. dollar’s strength is being examined, many have questioned whether or not the U.S. government will confiscate gold again. ‘No Crisis Should Go to Waste’ Over the last two years since the onset of the coronavirus outbreak, the world has been dealing with a....

While the price of bitcoin has surged during the first few days of October, the price of the precious metal gold has also increased percentage-wise as the U.S. dollar and the country’s 10-year Treasury yields slid in value this past week. An ounce of fine gold exchanged hands this weekend for $1,760 per unit, up 1.32% since September 29.

Gold Spikes More Than 1% This Past Week, Metal’s Rise Attributed to a Soft Dollar, US Default Fears, the Fed’s Upcoming QE and Benchmark Rate Decisions

After the end of September, like clockwork, bitcoin (BTC) and the....