ItBit Nets $25 Million, Launches NYDFS-Approved Bitcoin Exchange

New York bitcoin exchange itBit has closed $25m in Series A fundraising. The round drew support from a pool of new and existing sources including RRE Ventures, Liberty City Ventures and investor Jay W Jordan II. Raptor Capital Management chairman James Pallotta also participated in the round. ItBit further confirmed the addition of three new members to its board of directors: former Federal Deposit Insurance Corporation chairperson Sheila Bair; former New Jersey Senator Bill Bradley; and former Financial Accounting Standards Board (FASB) chairman Robert Herz. The three directors had....

Related News

Today, international bitcoin exchange itBit announced it had been granted a trust charter by the New York Department of Financial Services (NYFDS) under New York State banking law. This is the first such charter granted to a digital currency company by the NYDFS. ItBit also announced the successful completion of a $25 million Series A funding round and the expansion of their board of directors. Under the charter granted to itBit by the NYFDS, itBit is now able to accept customers from all 50 U. S. states in full compliance with state and federal law. "We have sought to move quickly but....

This piece has been updated with additional information regarding itBit's application filing. ItBit has filed an application for a state banking license in New York. In statements to CoinDesk, New York State Department of Financial Services (NYDFS) spokesman Matthew Anderson confirmed the filing. ItBit may be approved within the next few weeks, according to a report by Reuters, citing individuals with knowledge of the process. Notably, the banking license application reportedly names several well-known political and financial figures in the US, including former Federal Deposit Insurance....

In April, Bitcoin Magazine reported that Bitcoin exchange itBit had filed for a banking license in New York. Later in May, itBit was granted a trust charter by the New York Department of Financial Services (NYFDS) under New York State banking law, the first such charter granted to a digital currency company by the NYDFS. ItBit also announced the successful completion of a $25 million Series A funding round. On September 2, itBit announced the appointments of Daniel "Danny" Alter as the company's new general counsel and chief compliance officer, and Kim Petry as chief financial officer.....

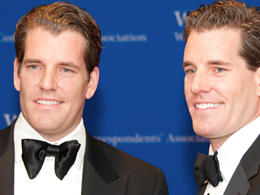

Entrepreneurs Cameron and Tyler Winklevoss have filed an application for a limited liability trust company in New York. The filing for Gemini Trust Company, if approved by the New York State Department of Financial Services (NYDFS), would enable the Winklevoss brothers to launch Gemini, their forthcoming bitcoin exchange product first announced in January. The announcement notably follows itBit's May announcement that it received a trust company charter from the NYDFS. Under New York banking law, trust companies are financial institutions that, while unique from banks, are able to take....

On July 21, 2015, Tyler and Cameron Winklevoss, the founders of Winklevoss Capital, filed an application with the New York Department of Financial Services (NYDFS) on behalf of Gemini Trust Company, LLC, which will operate as a New York Limited Liability Trust Company. According to a spokesperson, the Gemini exchange will be open to the general public as well as institutional investors once a Certificate of Authorization is issued by the NYDFS. Evan Greebel of Kaye Scholer is advising on this launch. This trust company structure is the same one used by NY-based bitcoin exchange itBit,....