A Sharia Compliant Bitcoin Platform Blossoms in Indonesia

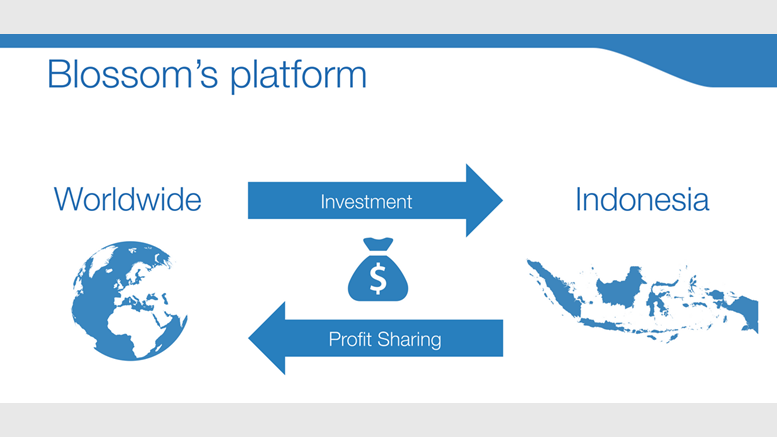

Blossom is a fintech company that offers Sharia complaint financial services to people in countries that are predominantly Islamic. The company successfully merges bitcoin and traditional microfinance into a single package. It is amazing how the culture, beliefs and practices vary from one region to another. A product that works in one country may not work in the neighbouring countries. Same holds good for finance also. The financial structure and practices vary depending upon the inherent cultural and religious beliefs of the population in that region. Research carried out in this regard....

Related News

In partnership with the Indonesian government, Kinesis is using blockchain technology to deliver gold-based financial services to the population. Kinesis, a gold-backed monetary system based in the Cayman Islands, has launched a Sharia-compliant version of its product in Indonesia, setting the stage for wider acceptance of its blockchain solution in the world’s largest Muslim-population country.The product, PosGO Syariah, is described as the first mobile ecosystem business in Indonesia to be compliant with Islamic law. Delivered as an application and powered by blockchain technology, PosGO....

Ruya Bank has launched in-app Bitcoin trading, becoming the first Shari’ah-compliant bank to let customers buy and sell the cryptocurrency using a mobile banking app. Related Reading: South Korea Tightens Grip On Crypto Exchanges, Imposes Bank-Level Standards According to the bank, the move follows approval by its Shari’ah-governance board and was built with a regulated […]

Islam is the fastest growing religion in the world, according to Pew Research Center, there are about 1.6 bln Muslims in the world and they make up roughly 23 percent of the world’s population. The majority of the world’s Muslims live in Asia Pacific in countries like Indonesia and India even though traditionally areas of the Middle East and Northern Africa are traditionally associated with Islam. Fintech according to Sharia. There are unique needs of Muslims when it comes to banking and finance. The Islamic Canonical Law, popularly known as Sharia is based on the teachings of the Quran....

Bahrain-based crypto exchange CoinMENA acquired a major license ahead of its launch in several countries including the UAE and Saudi Arabia. CoinMENA, a soon-to-launch cryptocurrency exchange headquartered in the Kingdom of Bahrain, has obtained a license from the Central Bank of Bahrain, or CBB.The newly acquired “Crypto Assets Services Company License” allows CoinMENA to operate fully as a regulated crypto exchange and onshore platform, the company announced on Jan. 24. The CBB’s license ensures that CoinMENA meets all of the operational, technical and security requirements set by the....

Navigating crypto is made more difficult for those with religious considerations and the founder of an Islamic law compliant DeFi platform has thousands of users seeking approved cryptocurrencies. Australian-based crypto platform Marhaba DeFi says there has been a strong take-up of Halal-approved cryptocurrency products on its platform, with aims to release a suite of new products which align with Islamic law by the end of 2022.Launched in 2020, the platform is focused on adhering to the rules of “Islamic finance” which refers to how businesses and individuals raise capital in accordance....