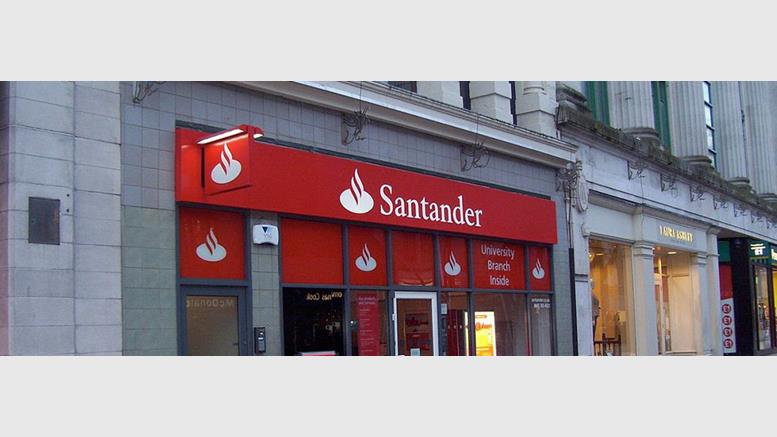

Santander: Banks and Innovators Should Join Forces to Create Fintech 2.0

Santander InnoVentures, Oliver Wyman and Anthemis Group have today published "The Fintech 2.0 Paper: Rebooting financial services." The paper is presented as "a call to action to banks, financial institutions and financial technology (fintech) businesses to work together to undertake a fundamental 'reboot' of the core processes, systems and....

Related News

Santander InnoVentures announced an open DL Challenge for fintech startups using Blockchain technology. The grand prize will be US$15,000 along with the promise of future angel investment. The goal of the DL Challenge is to “inspire innovation and encourage entrepreneurship” for startups worldwide. The competition is focused on mortgage processing, trade finance and asset leasing. Participants will be selected by a panel of DL and blockchain technology experts during the Challenge event in January, 2015. Mariano Belinky, managing partner of Santander InnoVentures, said: “Distributed ledger....

Four major international banks have joined forces to create their own cryptocurrency capable of facilitating transactions between branches. Few major international banks may soon have their own cryptocurrency. According to a recent media report, the banks that are initially going to be part of this initiative includes UBS, BNY Mellon, Deutsche Bank and Banco Santander. These four major banks, who also happen to be the members of R3 Blockchain Consortium are working alongside ICAP, a United Kingdom-based electronic dealer-broker. The main aim of this banking group is to develop cheaper and....

Santander Innoventures, the $100 million fintech venture capital fund of multi-billion dollar Spanish banking group Santander, has partnered with startup agency OneVest to run a Distributed Ledger (DL) Challenge for early-stage startups. Specifically, the bank will be actively searching for blockchain-based startups targeting mortgage processing, trade finance and asset leasing, and technologies which could help the bank bridge conventional payment systems with decentralized payment networks like the blockchain. "Distributed ledger technologies will create huge value for customers, banks....

In a new report, Santander InnoVentures, the megabank's venture capital fund, argues that banks and fintech startups need to collaborate in order to "reboot" the global financial services industry and trigger the 'Fintech 2.0' revolution. Unlike the first generation of fintech pioneers that are limited to relatively simple propositions such as digital wallets and peer-to-peer lending, 'Fintech 2.0' will deliver fundamental changes to the infrastructure and processes at the core of the financial services industry, according to a new report from Santander InnoVenture, co-authored with Oliver....

Santander InnoVentures has announced the launch of a global blockchain competition which seeks to support early stage startups using distributed ledger technology. The Spanish megabank's $100m venture capital firm - which recently participated in Ripple's $32m funding round - is offering the winner a $15,000 cash prize as well as access to its technology and business experts. Mariano Belinky, managing partner of Santander InnoVentures, said in a statement: "Distributed ledger technologies will create huge value for customers, banks and entrepreneurs who create new businesses around it. The....