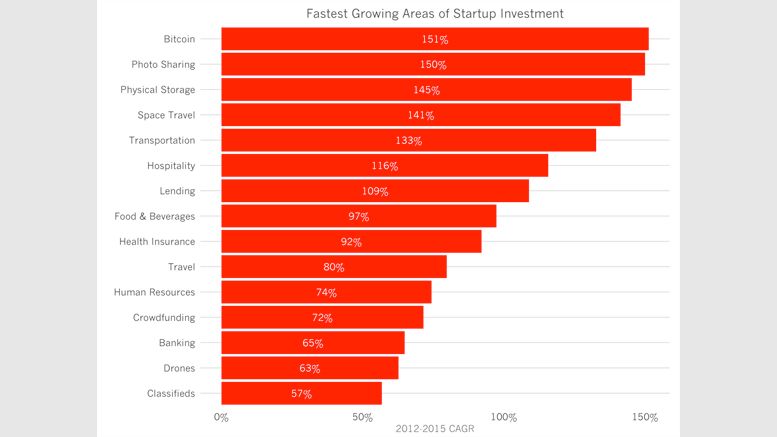

Redpoint VC: Bitcoin is Fastest-Growing Area of Funding

Bitcoin is the fastest growing area of startup investment since mid-2012, a venture capitalist at Redpoint has claimed. In his recent analysis of Mattermark data, Tomasz Tunguz noted that investment in bitcoin companies - closely followed by photo sharing and physical storage startups - has grown by 151% in the last three years. Image via Tomas Tunguz. However, Tunguz pointed out that bitcoin startups represent a

Related News

Tomasz Tunguz, a partner at venture capital firm Redpoint, has written a post titled "The Fastest Growing Areas of Startup Investment in 2015" on his personal blog. "Which lesser known startup sectors are starting to raise venture dollars?" asks Tunguz. "Where are founders finding unique opportunities to innovate?" The answer: Bitcoin is the fastest growing sector. Tunguz focuses on software investments. Prior to joining Redpoint, he was a project manager at Google working on AdSense. Before Google, Tunguz worked as a Java engineer at Appian Corporation, building tools for the Department....

This week, ABEY has announced that it has been adding an average of 20,000 active ABEY 2.0 addresses each week since the beginning of August 2021, making it one of the fastest-growing blockchains in the world and finishing an exceptional week that included the ABEY token being listed on Liquid Global, a premier international cryptocurrency exchange. ABEY developers say there are more than 120,000 active ABEY 2.0 addresses today, quadrupling from 30,000 addresses at the beginning of August. Developers say this growth began around the first airdrop of XT, the native token of XSWAP on August....

As crypto adoption continues to grow, Japan has emerged as the Asia-Pacific (APAC) region’s fastest-growing crypto market in 2025, eclipsing the likes of India, South Korea, and Vietnam. Several important advances in the crypto industry can be credited for Japan’s growth in the emerging sector. Japanese Crypto Ecosystem Witnesses Strong Growth According to a recent […]

Coinbase has managed to secure $25m in series B funding led by Silicon Valley-based venture capital firm Andreessen Horowitz. This brings the total amount raised by the company to $31.9m. The firm, which describes itself as an "international digital wallet that allows you to securely buy, use, and accept bitcoin currency", is going from strength to strength, with an estimated 600,000 people now using its wallet service, up from 200,000 in August. The $31.9m raised so far represents the biggest fundraising success of any bitcoin company, dwarfing Circle's $9m of Series A funding from....

Popular bitcoin buying and selling house Coinbase has announced that they have secured $25 million in series B funding. At the forefront of the funding is Andreessen Horowitz, a Silicon Valley venture capitalist firm. Gavin Andresen (who should not be confused with Marc Andreessen of Andreessen Horowitz) will be hopping aboard in an advisory position, as well. That brings the total raised by the company to a whopping $31.9 million, making it the most invested-in bitcoin-related company out there. "This funding solidifies our position as the largest and fastest growing bitcoin service in....