BBVA: Blockchain Tech Could Replace Centralised Finance System

Blockchain technology could be used to bypass today's centralised financial infrastructure entirely, according to a report by BBVA Research US. The report, titled Blockchain Technology: The Ultimate Disruption in the Financial System notes that the application of blockchain technology would first be useful in the payments space, where it would eradicate the need for any intermediaries and significantly reduce costs for banks. However, decentralised public ledgers could disrupt the financial system as a whole, adds the report. "Given that the majority of financial assets such as bonds,....

Related News

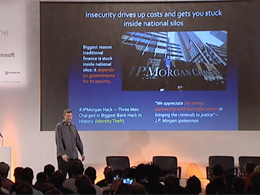

Smart contracts pioneer Nick Szabo has lauded the security benefits of decentralised monetary systems built using blockchain technology. Speaking at Ethereum'sDEVCON1 conference, held in London today, Szabo - often rumored to be the creator of bitcoin - gave an overview of the blockchain's history and highlighted the security inefficiencies of centralised systems typically used by traditional finance institutions. Centralisation is insecure, said Szabo, before noting mainstream finance's reliance on government and law enforcement officials for security: "This is one of the reasons why....

BBVA, a multinational Spanish banking group has published another report on the block chain technology entitled “Blockchain Technology: The Ultimate Disruption in the Financial System,” to explicate the advantages and unique applications of the block chain technology. Specifically, BBVA highlighted the block chain’s capability of storing identities and unforgeable data and its ability to settle secure transactions instantly. “In the financial industry, institutions were slow to recognize the potential of blockchain technology; however, dozens of large banks have now invested significant....

Several Bitcoin and blockchain firms have excelled at the global fintech competition BBVA Open Talent 2015 organized by BBVA. Among the leading names are Bitnexo, Bitso, Volabit, Bitwage, Snapcard and Safello. Safello recently also entered into a Proof-of-Concept (PoC) agreement with Barclays to co-create a Bitcoin platform. Frank Schuil, CEO of Safello said, "We are delighted to see mainstream banks embrace Bitcoin and look forward to getting a chance to work with BBVA to explore how our platform can benefit them. Our selection for Open Talent 2015 shows that his innovative technology is....

BBVA, the second-largest bank in Spain, has announced the launch of its bitcoin trading and custody service through its Swiss subsidiary. Beginning with bitcoin, BBVA plans to expand its services for other cryptocurrencies. BBVA Rolls Out Bitcoin Trading and Custody Services BBVA announced on Wednesday that it “has begun to roll out the trials of what will become its first commercial service for the trading and custody of digital assets.” BBVA (Banco Bilbao Vizcaya Argentaria) is Spain’s second-largest bank after Banco Santander. The group was founded in 1857 and has 727....

Ripple, a blockchain-based digital payment company, has unveiled a new agreement with Spanish banking leader BBVA. The new partnership will give BBVA access to Ripple’s technology as the Spanish bank launches a service that allows retail clients to buy, hold, and store cryptocurrencies. At the same time, the move will strengthen Ripple’s foothold in Spain, […]