Permissioned Blockchain For Banks Can Reduce Infrastructure Costs!

CEO of Tech Bureau Takao Asayama has unveiled Mijin, which is a low-cost solution for creating permissioned blockchain. The news to this effect came via a press release issued to the media which also made a lucrative claim; that the main aim is to "reduce infrastructure costs by up to 1000% by 2018." The press release further stated that Mijin is the platform that will allow anyone to set up a blockchain on a peer-to-peer network easily. It also said that it has the capability to easily replace traditional databases to create point systems, payment services, online games, airline mile....

Related News

Major banks and mainstream financial institutions are warming up to the blockchain technology that powers Bitcoin, and launching internal experiments and pilot projects to find out how they can use the blockchain. However, most banks frown at the chaotic anarchy of public "permissionless ledgers" like the Bitcoin blockchain, where any individual anonymous user can join and contribute hashpower to verify transactions without having to ask anyone's permission. Instead, they would prefer "permissioned ledgers" owned and by the banks, which can be operated only by vetted players. Think of....

More and more banks are trying to explore the potential applications of blockchain technology in their operations. Some say that this could reduce clearing times and costs for trades while also providing a more secure approach to record-keeping. However, most banks are traditional in their approach and have a lot of homework to do when it comes to updating their systems, let alone understanding the complex blockchain technology. For Deutsche Bank Research analyst Thomas Dapp, banks need to first solve their legacy problems before adapting to new systems. Blockchain and Legacy Problems. "I....

In many recent articles, Bitcoin Magazine reported the trend toward private, "permissioned" non-Bitcoin blockchains, supported by Accenture and Digital Asset Holdings CEO Blythe Masters, among others. Permissioned blockchain developments for banks and financial operators have been started by giant Swiss bank UBS, Bitcoin exchange itBit and more. Permissioned blockchains would offer the advantages of digital currencies powered by public blockchains - fast and cheap transactions permanently recorded in a shared ledger - without the troublesome openness of the Bitcoin network where anyone can....

Since it first came to prominence over 6 years ago, many questions have risen regarding the validity and safety behind bitcoin. Many are also wondering if it truly has a place in contemporary society. Will bitcoin be a long-lasting trend, or will it die out? Can it survive the ups-and-downs, or will its popularity fade away? There is evidence circulating to suggest that the coin may be at risk of ceasing to exist, but that the technology behind it may become as revolutionary as the Internet itself. Through a recent survey, the World Economic Forum has labeled the blockchain as one of the....

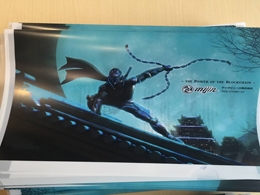

Promoting a Bitcoin business is key to reaching a mainstream audience. Gone are the days in which a simple standard press release was enough to sway droves of customers to sign up for a new service. Marketing has evolved over time, but permissioned blockchain platform Mijin is taking things to the next level. Bitcoin and ninja’s make for excellent public....