Bitcoin Firm Digital CC Drops 'Mining' for Remittance

As per a report by The Sydney Morning Herald, Bitcoin firm Digital CC (ASX: DCC) has said that it is dumping 'mining' and is now entering the remittance market as it sees a more profitable scenario in money-transmitting operations. What makes the news more worthwhile is the fact that this Bitcoin company was the first miner to be publicly listed on the ASX, and hence, its declaration is bound to create ripples in the market. The report further cites Executive chairman Zhenya Tsvetnenko who said that the decision to shift out from the mining business was because the company was losing....

Related News

Multinational insurance and asset management company AXA is eyeing bitcoin to help streamline the remittance market, the general partner of its VC fund has told CoinDesk. Minh Q Tran said AXA Strategic Ventures, the firm's $223m fund, and its accelerator, AXA Factory, are treating digital currency as an "investment thesis". He said: "We think that many use cases related to bitcoin have not already been explored. In particular we are very interested in how bitcoin, and more generally cryptocurrencies, might be used in the remittance market." Though no bitcoin or blockchain startups have....

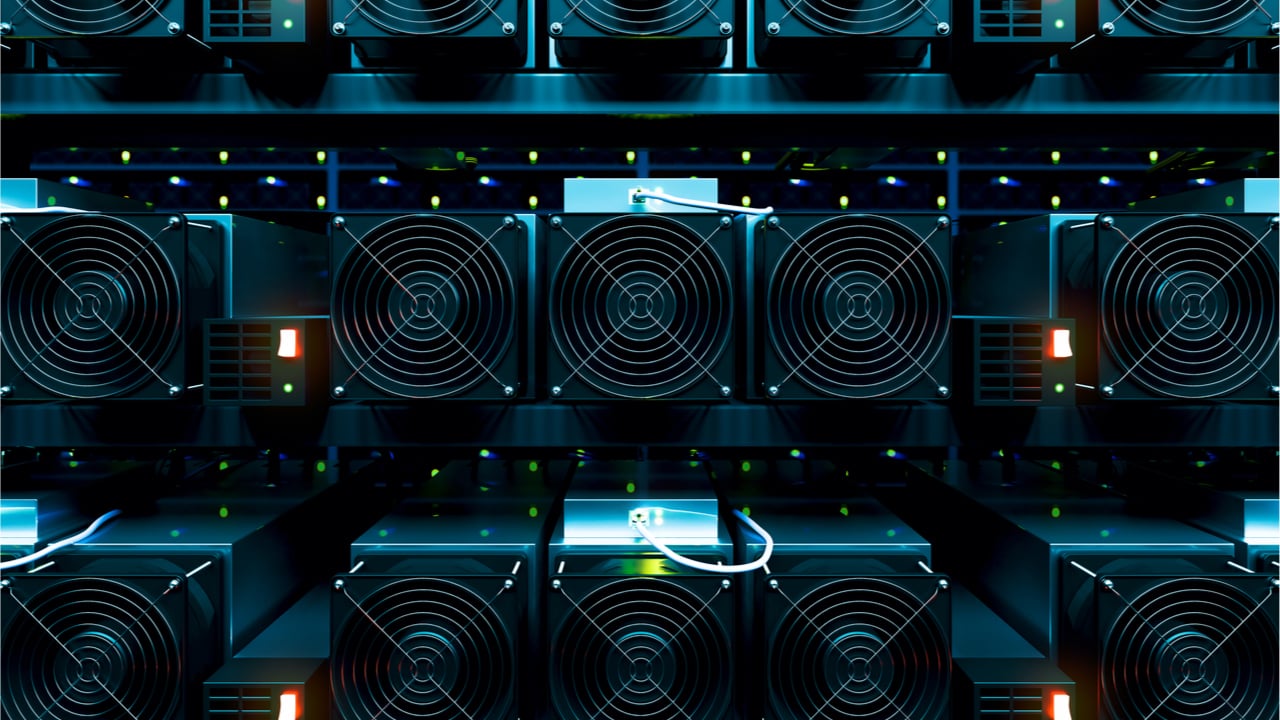

On Tuesday, the bitcoin mining firm Genesis Digital Assets announced the firm raised $431 million from strategic investors. The mining company Genesis detailed that Paradigm led the multi-million-dollar funding round and one of the firm’s co-founders has joined Genesis’s board of directors.

Genesis Digital Assets to Bolster Bitcoin Mining Operations in the US and Nordics

The industrial-scale bitcoin mining company, Genesis Digital Assets, revealed the firm has raised $431 million in a recent financing round. The funding was led by the company Paradigm but also....

Platforms listing ads for mining hardware have been registering declining demand since Bank of Russia’s call for a ban on the minting of digital currencies among other crypto activities. While mining may eventually be legalized, miners can expect to pay higher electricity bills.

Supply Exceeds Demand on Russian Market for Mining Chips

Mining hardware is now more often offered than sought, Russian online marketplaces have noticed. The trend began after the Central Bank of Russia (CBR) published a consultation paper this month, in which the regulator proposed a blanket ban....

DigitalBTC, an Australia-based digital payments company, has agreed to form a joint venture company (JVC) to distribute and market a remittance product, AirPocket. The beta launch will begin in the second quarter of this year. DigitalBTC, which is trading on the Australian Securities Exchange as Digital DC Limited, described AirPocket as a disruptive new technology product targeting the significant and established remittance market. The U. S. to Latin America remittance market is estimated to be $84 billion. The joint venture will target the remittance sector in the Latin American and....

Ghanian startup Beam has announced to shutdown its international Bitcoin remittance services, the Disrupt Africa reported. Launched in October last year by Nikunj Handa and Falk Benke, the company was launched to address the growing inward remittance needs of Ghanian people. According to The World Bank's latest report, a 70% of the Ghana's population doesn't have access to even basic banking facility, a factor that makes Bitcoin a potential contender in this territory. But even these supportive factors have failed to impress Beam's owners. As reported, Handa has left the business and Benke....