How to Prepare Yourself to Manage Bitcoin and Taxes?

As a wise man once said, there is no escaping taxes and death once you are born. When Bitcoin was introduced, however, there was a glimmer of hope, most of us thought that we might just be able to escape taxes. Unfortunately, it was short lived, as the IRS decided to impose taxes on virtual currency holdings. Now that Bitcoin is considered as an official asset by various government agencies in the United States, one can do nothing but pay the toll. How do we know what is taxable and what is not? Well, for that we have a few experts who can help us understand, but it will be easier if you....

Related News

If you’ve gone deep in the current crypto craze, you might need to prepare your heart once you do your crypto taxes. Crypto may have started out as a humble money gig, but with its total value at nearly $2 trillion, many are betting it’s “the future of money.” However, its growing popularity has come […]

Koinly is a tax solution for cryptocurrency investors and accountants. Anyone who owns multiple exchange accounts or wallets knows the pains when it comes to declaring taxes. Koinly was built to solve this very problem – by integrating with all major blockchains and exchanges Koinly reduces crypto tax reporting to a few minutes of work.

Robin Singh is the Founder of Koinly. He recently joined the Bitcoin.com News Podcast to talk about the challenges crypto users face with regards to taxes in 2022:

Koinly currently supports USA, UK,....

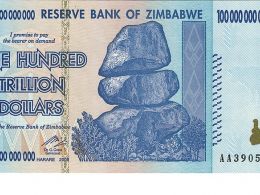

Inflation is one of those read-the-small-print kind of taxes that people don’t often think about even though it can have a major impact on their finances and, thereby, on their lives. Rising long-term inflation is more insidious than you might think because it can steadily and most assuredly decrease the value of your earnings/savings – especially, if your taxes aren’t indexed to compensate you for the cost of inflation. Inflation has always been the bane of many businesses and individuals alike. One thing is clear: something needs to be done. If cryptocurrency, perhaps Bitcoin, was....

Most transfers of cryptocurrency are taxable, unless the transfer is qualified as a gift or a charitable contribution. Way back in 2014, the United States Internal Revenue Service (IRS) ruled that cryptocurrency is property in Notice 2014-21. That classification as property has some big tax consequences accentuated by wild price swings. Buying and selling crypto can trigger gain or loss and be taxable. Yes, buying something using crypto — a house, a car, a new suit — can trigger taxes. Even paying taxes in crypto can trigger taxes.If you owe $5,000 in taxes, you could pay the $5,000 in....

This tax season, it may be worthwhile to consider making a bitcoin donation to reduce one’s taxes through philanthropy.