The Retail Sector Foresees the Rise of Bitcoin by End of Decade

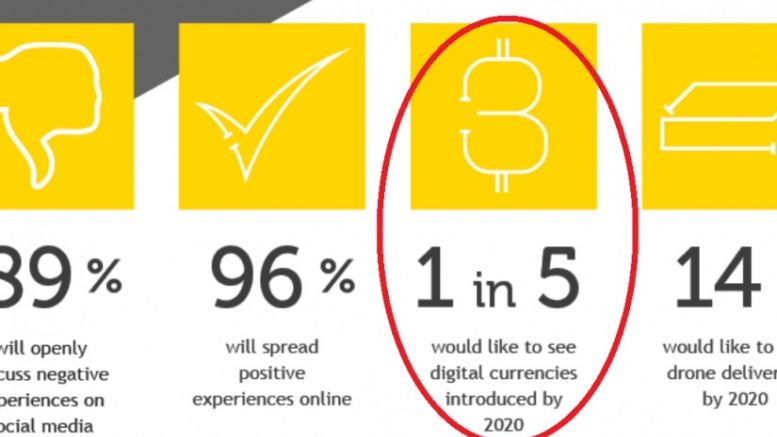

Bitcoin is expected to play a major role in the retail sector by the end of this decade, shows a survey conducted by Infomentum. The results of the survey was published in the report - Beyond Digital. The retail industry is one of the largest sectors in the world. The process of buying and selling goods has been around since the concept of money was introduced to mankind. Until now, the retail sector has not seen much change in the way trade is conducted. But in the coming years it may start bearing a new look resembling scenes from old science fiction movies. Bitcoin will also be included....

Related News

JPMorgan expects blockchain use in finance to increase as the crypto sector grows. The global investment bank says, “We want to make sure that we are able to not only support that but also be ready to provide related services.”

JPMorgan’s Blockchain Plans

JPMorgan Chase & Co foresees increased blockchain usage in traditional finance and is getting ready to offer related services, Bloomberg reported Thursday.

The global investment bank has been using a blockchain for collateral settlements, allowing its clients to use a wider range of assets as....

A landscape that gives more power to retail investors and the influence of celebrity endorsement have driven bitcoin’s recent rise.

Per a survey published by Bitstamp, the crypto space is on track to become a mainstream industry. The platform conducted a survey with over 28,000 participants, 5,400 senior institutional decision-makers, and 23 retail investors, across 23 global markets to try and take a pulse on the sector. Related Reading | Dogecoin (DOGE) Jumps 30% After Elon Musk Buys Twitter Since its inception, digital assets have grown into a $2 trillion industry at its all-time high. Once an interesting way for tech-savvy individuals to send money across the world, the participants of Bitstamp’s survey claim....

On-chain data shows XRP retail investors are up 60% even after the market downturn. Here’s how the figure compares for Bitcoin and Ethereum. XRP Retail Realized Price Puts Profit Margin Around 60% In a new post on X, on-chain analytics firm Glassnode has discussed how retail profitability compares between the top assets in the sector: […]

Morgan Report founder David Morgan foresees a supply crunch for silver, and says that in ten years’ time, it will be one of the best investments of the decade. One analyst, however, says if the precious metal falls below $18, it’s “very possible that we could see silver get absolutely smoked.” In other news this week, the Federal Deposit Insurance Corporation (FDIC) has issued a crypto-related cease and desist order to popular cryptocurrency exchange FTX US, and four others. All this and more, in the latest Bitcoin.com News Week in Review. Analyst Says if....