Bitcoin Startup Hedgy Seeks Second Life as Blockchain Firm

Hedgy is no longer in the bitcoin derivatives business, according to CEO Matt Slater. In a new interview, Slater said that Hedgy has pivoted from its original positioning as a bitcoin derivatives and smart contracts startup, aiming to recast itself as a blockchain applications development platform similar to Chain or Gem. Hedgy raised $1.2m last April from a list of notable VCs including Draper Fisher Jurvetson partner Tim Draper, Salesforce CEO Marc Benioff, and Sand Hill Ventures. At the time, the startup had sought bitcoin miners and merchants to use its tools, enabling them to lock in....

Related News

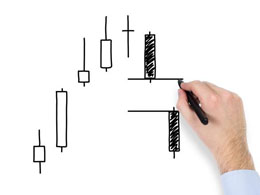

A new startup named Hedgy is looking to tackle one of bitcoin's biggest problems - volatility. While an entire industry including payment processors, wallets and data-driven tools has been built around bitcoin, the thorny issue of how to reduce its volatility against more familiar fiat currencies still remains. The team at Hedgy thinks that the ability to use multi-signature addresses to execute derivative contracts might be a way for bitcoin companies to "hedge," or mitigate, the risk inherent in bitcoin's fluctuating value. Matt Slater, CEO of Hedgy, told CoinDesk he believes his startup....

The Boost VC Tribe 4 graduate Hedgy completed a $1.2 million funding round from investors including Tim Draper, Salesforce CEO Marc Benioff and Sand Hill Ventures. Hedgy, founded in April 2014 is the first Bitcoin startup to create multisig powered smart contracts to protect merchants from the price volatility of bitcoin. Initially, under the project name Coindash, Matt Slater (co-founder and head of trading) and Juan Pineda (co-founder and head of technology) worked together in Boost VC's bitcoin hackathon to create prototypes of the world's first programmable smart contracts for....

Hedgy, Inc., a San Francisco, Calif. -based, Boost VC-accelerated startup, has launched a block chain-enabled, over-the-counter hedging product for commercial bitcoin miners. MegaBigPower, a Wenatchee, Wash. -based bitcoin miner, and Crypto Facilities, a London-based derivatives broker, will offer a smart contract for hedging bitcoin mining proceeds at a fixed price for delivery on a future date. In traditional finance, the product operates like a forward contract. Hedgy, by utilizing the bitcoin blockchain, programs contracts to "self enforce" and settle as soon as contract terms are....

Bitcoin derivatives startup Hedgy has raised $1.2m in new seed funding from a group of 10 investors that includes Draper Fisher Jurvetson partner Tim Draper, Salesforce CEO Marc Benioff and Sand Hill Ventures. In conjunction with the announcement, Hedgy has also launched a new derivatives product aimed at commercial bitcoin miners. Miners that use the derivative can effectively lock in a future price at which they can sell bitcoins, using a smart contract to settle the transaction on the bitcoin blockchain. Drawing price metrics from TradeBlock, the new product is the result of a....

Blockchain-based smart contract platform Hedgy, which previously raised US$1.2 million in a seed funding round led by Salesforce CEO Marc Benioff and Draper Fisher Jurvetson partner Tim Draper in April 2015, has released a demo of its blockchain-based software that allows commercial traders to "independently create, enforce and physically settle OTC forward contracts." A forward contract, which is also known to be the backbone of derivatives, is a type of a derivative instrument which acts as a bilateral agreement between two counterparties looking to buy or sell an asset or commodity for....