CFTC Commissioner: Credit Default Swap Test ‘Proves Merit’ of Blockchain

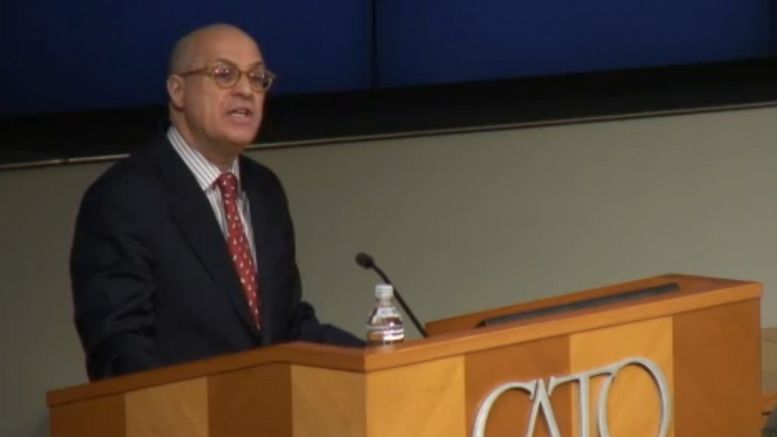

Recently completed blockchain and distributed ledger tests at major financial institutions are "proving the merit" of the technology, J Christopher Giancarlo, commissioner of the US Commodity Futures Trading Commission (CFTC), said today. In a keynote address at an event held today by the Cato Institute, Giancarlo cited a recent "successful test" of the use of blockchain in the credit default swaps markets. Announced earlier this month, the trial was organized by the DTCC and involved participation from Bank of America, Citigroup and Credit Suisse, as well as industry....

Related News

LedgerX, an institutional bitcoin trading and clearing platform, announced this week that Mark Wetjen, the ex-commissioner of the U. S. Commodity Futures Trading Comission (CFTC), will join its board. Nominated by President Barack Obama in 2011 and unanimously confirmed by the Senate as one of the five CFTC commissioners, Wetjen both helped to implement the first trading mandate for certain types of interest rate and credit default swaps and pushed the CFTC to undertake approximately 95 enforcement cases under the Dodd-Frank Act and Commodity Exchange Act. He also served as the acting....

A commissioner with the Commodity Futures Trading Commission (CFTC), Dawn Stump, has voiced concerns about cryptocurrency regulation through enforcement — the approach taken by both the CFTC and the U.S. Securities and Exchange Commission (SEC).

CFTC Commissioner Stump on Crypto Regulation

CFTC Commissioner Dawn Stump has raised concerns regarding the approach her agency and the U.S. Securities and Exchange Commission (SEC) are taking to regulate the crypto industry. The commissioner is a vocal proponent of clarifying guidelines for crypto assets.

In an....

A commissioner of the Commodity Futures Trading Commission (CFTC) has spoken about the inadequacies and inefficiency of the current "closed ledger" banking system. He adds that distributed open ledgers could revolutionize financial ecosystems while noting certain "disruptive" implications for the current financial industry and those who are a part of it. Commissioner J Christopher Giancarlo spoke about bitcoin and the blockchain in a wide-ranging lecture on Fintech and international finance at the Harvard School of Law on December 1st. In a guest lecture that began with a disclaimer that....

Keaghan Ames worked at Credit Suisse for more than two years as vice president and head of U.S. regulatory policy, which included advising executives on digital assets regulation. In a Friday announcement, Pham said Keaghan Ames will be her counselor and senior policy adviser at the CFTC starting May 23. Ames worked at Credit Suisse for more than two years as vice president and head of U.S. regulatory policy, which included advising executives on digital assets regulation. He will be joining the CFTC from the Institute of International Bankers, where he has been the director of government....

Seven Wall Street firms including four global banks have announced the successful testing of blockchain technology used for credit default swaps’ trading process in post-trade lifecycle events, a market wherein outstanding contracts amount to in the trillions of dollars. In a new initiative that further underlines the financial industry’s determined foray into embracing blockchain technology, seven Wall Street firms have announced the successful test of blockchain technology used for credit default swaps (CDS). Credit-default swaps are fundamentally insurance contracts which are paid off....