BitCoinIRA.com Launches Revolutionary “Bitcoin IRA” Investment Product Exclusively for Retirement Accounts

A first-of-its-kind, the “Bitcoin IRA” offered by BitCoinIRA.com, is specifically tailored for inclusion with IRA and 401(k) Plans.

BitCoinIRA.com, a financial conduit pioneering the use of bitcoin as a retirement tool, today announced its official launch of the “Bitcoin IRA.” The company will offer a unique alternative to traditional IRAs for investors who are seeking to diversify their portfolio and protect their retirement savings and 401(k) plans.

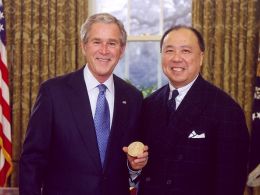

Edmund C. Moy, former Director of the United States Mint, serves as the Company’s Chief Strategist, and provides the company with his in-depth knowledge and decades of experience in currency trading and global economic markets.

“Bitcoin is unique in that it’s a completely decentralized currency,” said Moy, who served as the Mint’s 38th Director from 2006-2011.

“Thanks to its truly global nature, it has a lower risk of collapse than more traditional investment assets, which depend on the strength of the dollar. I’m thrilled to be working with BitCoinIRA.com at the forefront of this exciting new market.”

The “Bitcoin IRA” is distinct from other bitcoin investment options because it allows investors to possess actual bitcoins from a digital currency exchange in an IRA-designed security wallet. The company is the first to offer real bitcoins as part of a retirement portfolio, as opposed to the more volatile bitcoin-related derivatives such as stocks or exchange-traded funds, which are highly dependent on the strength of the dollar.

“This is a pioneering event in the retirement industry. For the first time ever, IRA owners can hold actual bitcoin in a private and anonymous securitized wallet. This will pave the way for more alternative investments for years to come. We are thrilled to be a part of this moment in history,” says Chris Kline, Chief Operating Officer at BitCoinIRA.com.

To ensure the quality and security of its financial services, BitCoinIRA.com has entered into an exclusive partnership with Palo Alto-based BitGo, the industry leader in blockchain security and multi-signature wallets, which supports over $1 billion worth of transactions every month.

"We are humbled that BitGo's treasury management and policy controls will facilitate the secure storage and safe access of digital currencies for BitCoinIRA.com and its customers. We look forward to the growing use of digital currencies and the portfolio diversification for retail and institutional customers alike," said Jonathan Silverman, Director of Strategic Initiatives for BitGo.

“In these increasingly uncertain economic times, digital currencies like bitcoin will continue to grow in appeal and value,” says Moy.

“BitCoinIRA.com offers a way for people to protect themselves against a volatile and unpredictable market.”

About BitCoinIRA.com

BitCoinIRA.com, a provider of Bitcoin IRAs serves as a financial conduit pioneering the use of bitcoin as an investment option for retirement, offering a unique alternative for self-directed IRAs. Working with FinTech industry leaders to provide secure, high-quality bitcoin investments, BitCoinIRA.com provides an innovative approach for investors to build their 401(k) and protect their retirement savings against market turmoil.

To learn more about BitCoinIRA.com, visit: http://www.BitCoinIRA.com/

About BitGo

BitGo is the leader in Bitcoin security and a pioneer of multi-sig technology. The company offers BitGo Enterprise, an enterprise-grade, multi-sig, multi-user Bitcoin wallet, and BitGo Platform API, a robust set of tools and services to access the underlying platform. The company was founded by veterans in online security, digital currency, and financial technology, and has raised more than $14 million in financing to date.

To learn more about BitGo, visit: http://www.BitGo.com/

Related News