Ether Price Surges 50% as The DAO Draws Trading Interest

While bitcoin has long dominated the digital currency space, ether has been grabbing headlines – and trading volume – this week as global market participants rally around the digital currency. The price of ether – the digital currency used by the Ethereum platform – surged by upwards of 50% in the seven days through 20th May, according to figures from US-based digital currency exchange Poloniex. Bitcoin prices, alternatively, fluctuated less than 5% during the aforementioned time frame. Ether had an opening value of $10 at 12:00 UTC on 13th May, additional Poloniex data reveals. The....

Related News

Bitcoin’s price jumped on news of payments firm Square’s investment while traders have amassed over $165 million in ether options open interest for December expiration.

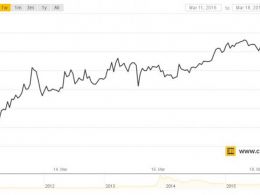

Markets Weekly is a weekly column analyzing price movements in the global digital currency markets, and the technology's use case as an asset class. Bitcoin prices traded largely between $410 and $420 during the week between 11th March and 18th March, as 30m BTC was traded on exchanges globally. The digital currency’s price movements were largely subdued, starting the week out at $416.24 on 11th March at 12:00 UTC before surpassing the $420 level at 09:10 UTC. For the remainder of the week through 12:00 UTC on 18th March, the digital currency remained range-bound between $410 and $420.....

Institutional investors have been bearish toward Ethereum for a while now. There have been outflows rocking the digital asset until it ended its 11-week streak with inflows for last week. However, this does not mean that positive sentiment had returned entirely to the cryptocurrency once more. The numbers on the CME show that institutional investors remain wary and even bearish toward the second-largest cryptocurrency in the market. Ethereum Falls Into The Negative The Ether futures on the CME have been trading on a negative basis lately, which basically means they are trading below spot.....

The digital currency ether classic (ETC) surged more than 30% on 29th December, reaching its highest price in over four months. ETC, the signature token of smart contract-based platform Ethereum Classic, rose to as much as $1.46 during the session, a 31.5% increase from the currency’s opening price of $1.11, CoinMarketCap data reveals. Ethereum itself grew by as much as 13.7% today. Ethereum classic also benefited from a sharp increase in transaction activity, as 24-hour trading volume climbed above $7.6m, after falling below $500,000 at some points over the last week. Several market....

The volume on Ethereum futures flipped Bitcoin's after hitting a new record at $10 billion, and derivatives data suggests further upside for Ether price. In the past 30 days, Ether (ETH) price decoupled from Bitcoin (BTC) to post a 67.5% gain, while the leading cryptocurrency price has barely moved. Ether's $3,605 all-time high on May 5 was responsible for boosting the asset's futures open interest to $10 billion.This movement brings up some crucial questions as the dominance of Bitcoin's derivatives markets appears to be challenged at the moment. On May 4, Ether's aggregate futures....