Central Banks Indirectly Shape Bitcoin Disruption With Bad Policy

For the longest period, central banks and the Federal Reserve held all of the power in the financial world. Although very little has changed then, there are concerns regarding the “magical power” associated with these institutions. Moreover, it seems implausible central banks will aid in recovering after the financial crisis. When looking for ways to....

Related News

The root cause of this problem is how a central bank is the “only player in town” to address economic turmoil. One thing most financial experts seem to agree on these days is how central banks find themselves in a precarious position. The Federal Reserve is sharing that opinion, as they feel central bank policy is doing more harm than good. In fact, 70% of bankers believe the monetary policy is a thing of the past. Central banks are on very thin ice, and more cracks start to appear every single day. Central banks have been using some interesting monetary policy options for several decades....

Forecasting how the global economy will evolve is becoming all but pointless. Anyone can create their own forecast and be right up to a certain extent, but the long-run scenario is impossible to guesstimate right now. Bitcoin users have no love lost for central bankers, and vice versa. Many central banks use rather unconventional monetary policy tools, which is causing friction within the banking sector itself. Something will have to change, as the advantages of Bitcoin and digital currency over central banks become more apparent every day. When people in the Bitcoin world hear the term....

Central banks are paying very close attention to stablecoins, seeking to control them — and decentralization may be the solution. Over the last couple of years, we have seen a lot of interest from central banks and governments in the stablecoin market. The reason behind it lies in the development of central bank digital currencies, or CBDCs.The idea of issuing a digital alternative to cash is a great motivator for central banks. It allows them to gain more control over the transition and processing of cashless transactions, which are currently overseen indirectly through private payment....

On this episode of "Fed Watch," the hosts discuss the year's policies from the world's foremost central banks. The post Reviewing Central Bank Policy In 2020 With Fed Watch appeared first on Bitcoin Magazine.

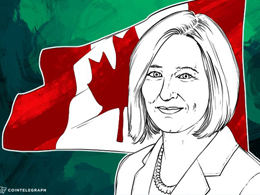

Carolyn Wilkins, senior deputy governor of the Bank of Canada recently warned banks about the effect that cryptocurrencies like Bitcoin can bring to the monetary policy. According to the speech “Innovation, Central-Bank Style” Canada’s banks should manage the risks and benefits that could arise from the broader adoption of e-money. According to Carolyn Wilkins: The senior deputy governor of the Bank of Canada stated that according to the corporate plan the bank will explore modern financial and technology trends over the course of three years. The bank will focus on studies of modern....